Tax forms: Salaries and revenue increase, contributions decrease

December 10, 2018

Tax forms: Salaries and revenue increase, contributions decrease

Columbia revenue was on the rise in the 2016 reporting year, but so were the college’s personnel costs.

Columbia reported higher revenue and net assets for its 2016-2017 fiscal year, according to recently-released IRS 990 tax forms, but the gains came with a decrease in contributions and grants and bigger payments for administrative compensation.

The 990 tax forms, an annual document completed by nonprofit organizations and institutions, are released to the public 18 months after they are filed. The forms were released in November and contain information from the 2016–2017 fiscal year, such as contributions and grants, total revenue, assets and administrative compensation.

CONTRIBUTIONS AND GRANTS:

Contributions and grants dropped about $1.2 million—to $5.6 million—for the 2016-2017 fiscal year.

The drop represents a 17 percent decrease from the $6.8 million the college received the prior year.

David Bea, principal and manager at Bea and Vandenberk Law Office and expert in nonprofit tax law, said contribution gaps are not uncommon after turnover in the development department.

“You are always having to renew your donor base,” Bea said.

Vice President of Development and Alumni Relations Shawn Wax joined Columbia in 2017 and was not at the college during the decrease in contributions and grants. He said fundraising numbers will decrease the following year as well.

Wax said the report on contributions and grants will be bleaker next fiscal year because the programs he has put into place will not yield results for several years.

Wax also noted that alumni participation—the percentage of a college’s alumni base that makes donations—was less than one percent. At a private institution, alumni participation is usually between 25—50 percent.

Wax said asking for donations from specific departments has been successful. In the past year—not yet reported to the IRS—his fundraisers got contributions and grants back to approximately $6 million.

“There was no one here to see folks,” Wax said. “Now we have a full staff and a full team, and every time we go see people and have a conversation about Columbia, the response is overwhelmingly positive and people are making donations.”

Wax made it a goal for fundraisers who find potential donors to make 14 face-to-face meetings or visits every month.

Wax would also like to try to include students in the fundraising initiative but does not yet know how he could do that. He said his previous work at the University of Illinois and the University of Iowa was successful, and he is eager to explore similar ideas at Columbia.

“Fundraising is a relationship business, and it takes time to establish and build a relationship,” Wax said.

TOTAL REVENUE AND EXPENSES:

Total revenue at the college increased $25 million—to $275,842,222—for the 2016-2017 fiscal year, including an approximate $40 million increase in non-tuition revenue reported as “other revenue.”

Senior Vice President for Business Affairs and CFO Jerry Tarrer said the substantial increase in other revenue was mostly from the sale of the University Center. Tarrer also attributed the increase in assets to growth in investments.

Net assets or fund balances increased about $64 million—to $360,026,663—for the 2016-2017 fiscal year.

Bea interpreted the asset report as a positive sign. “If you look at the assets, things look healthy,” he said. “The managers are doing a good job.”

The college reported an increase in assets and net income and a decrease in liabilities and expenses.

Total expenses dropped about $4 million to $236,773,481. During the 2016-2017 fiscal year, the college employed 4,075 people, 21 fewer than the prior year.

“We did what we could to contain costs,” Tarrer said. “There’s always conversations about how we’re spending the money and if there are opportunities to more wisely use those resources.”

ADMINISTRATIVE SALARIES:

Payment for salaries, employee benefits and other compensation increased by $1,388,678. Total compensation includes base salaries, bonuses, benefits and other reportable compensation recorded by fiscal year.

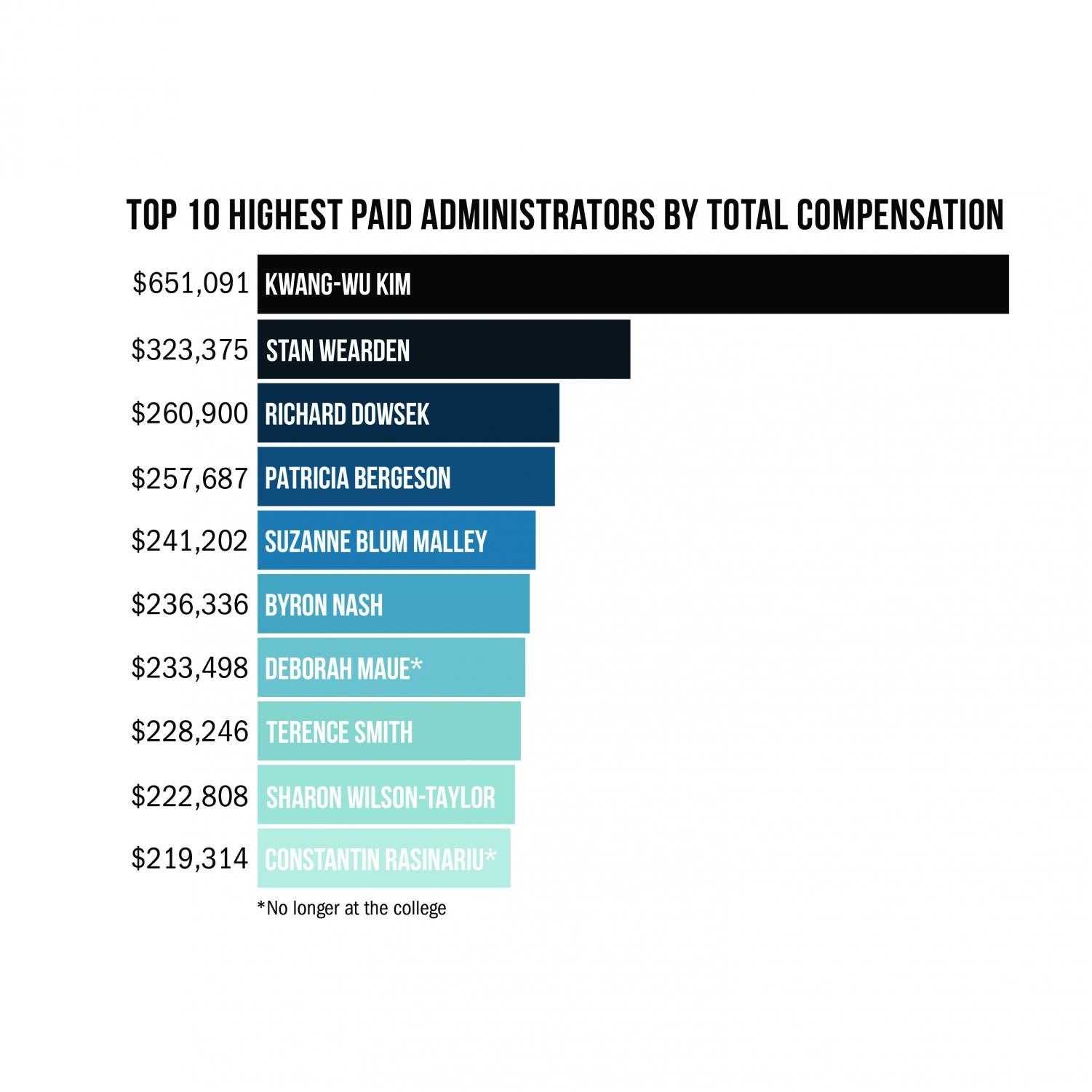

The forms include compensation for several administrative and faculty employees, reported as a total of salary and benefits and any deferred compensation. The highest-paid employees include President and CEO Kwang-Wu Kim with a total compensation of $651,091; Senior Vice President and outgoing Provost Stan Wearden with a total compensation of $323,375; former Vice President of Business Affairs and CFO Richard Dowsek—who stepped in as interim CFO in Spring 2016 after the departure of Michelle Gates—with a total compensation of $260,900; Vice President of Legal Affairs and General Counsel Patricia Bergeson with a total compensation of $257,687 and Senior Associate Provost Suzanne Blum Malley with a total compensation of $241,202.

The 2016 form also includes the first year of Vice President of Student Affairs Sharon Wilson-Taylor’s salary after she succeeded Mark Kelly in September 2016. Wilson-Taylor’s total compensation was $222,808. Kelly’s total compensation through Aug. 6, 2016, was $212,645.

Other employees annual compensation listed on the form include former Dean of Graduate Studies Constantin Rasinariu, $219,314; former Dean of the School of the Fine and Performing Arts Onye Ozuzu, $214,715; Dean of the School of Liberal Arts and Sciences Steven Corey, $195,933; former Vice President of Marketing & Communications Deborah Maue, $233,498; former Associate Vice President of Technology Services Byron Nash, $236,336; Associate Vice President of Budget Planning and Analysis Cynthia Gonya, $212,699; Special Counsel for Labor Relations Terence Smith, $228,246; Former Associate Dean John Green, $205,129; and former Dean of the School of Liberal Arts and Sciences Deborah

Holdstein, $195,999.

The 2015 form listed Kim as the only administrator to receive a bonus—$40,000—double his bonus for the previous year. Kim also received a bonus of $41,000 in 2016. The 2016 form lists Green as the only other person to receive a bonus, $14,687.

ENDOWMENT:

Columbia’s endowment increased for the second year in a row, growing from $131,641,189 at the beginning of reporting year 2015 to $141,980,157 at the beginning of reporting year 2016. The college ended the year with an endowment of $173,049,139.

“The [investment] market was kind to a lot of institutions, and a lot of higher education institutions saw their endowments improve that year,” Tarrer said.

The Board of Trustees decided 95.46 percent of the funds were board-designated, meaning the funds would be put toward the endowment fund.

Permanent endowments, for which the donor decides funds should be used specifically for endowment, were 1.5 percent of the total endowment. Temporarily restricted endowment funds, which are maintained for a specified amount of time, were listed as 3.04 percent of the total amount.

The college also listed investments of $51,462,000 on its Statement of Activities outside the US (schedule F). The investments are not listed on the 2015 form. Associate Vice President and Controller Matt Jaehrling said the difference can possibly be attributed to reporting requirement changes by the IRS that required the college to break down investments differently.

The college hires fund managers who buy mutual funds for the endowment, Tarrer said.

“They’ll make decisions as to where to plop that funding,” he said. “It depends on who the fund manager is that we’re hiring and where they’re actually investing our dollars that sit in our endowment.”

Correction 12/10/18 at 1:10 p.m.: Constantin Rasinariu’s name was misspelled in a previous version of this article. The Chronicle regrets this error.