The Chicago Coalition for the Homeless continues to campaign for Chicagoans to vote in favor of the Bring Chicago Home referendum, despite the legal wrangling over the ballot measure’s validity.

Mary Tarullo, associate director of policy and strategic campaigns for the Chicago Coalition for the Homeless, said in a press conference on March 5 that Bring Chicago Home was created by “a coalition of community organizations and unions across the city, fighting for a dedicated revenue stream to address homelessness in Chicago.” Together, they have been lobbying the mayor and members of the City Council, hosting town halls and canvassing in the community.

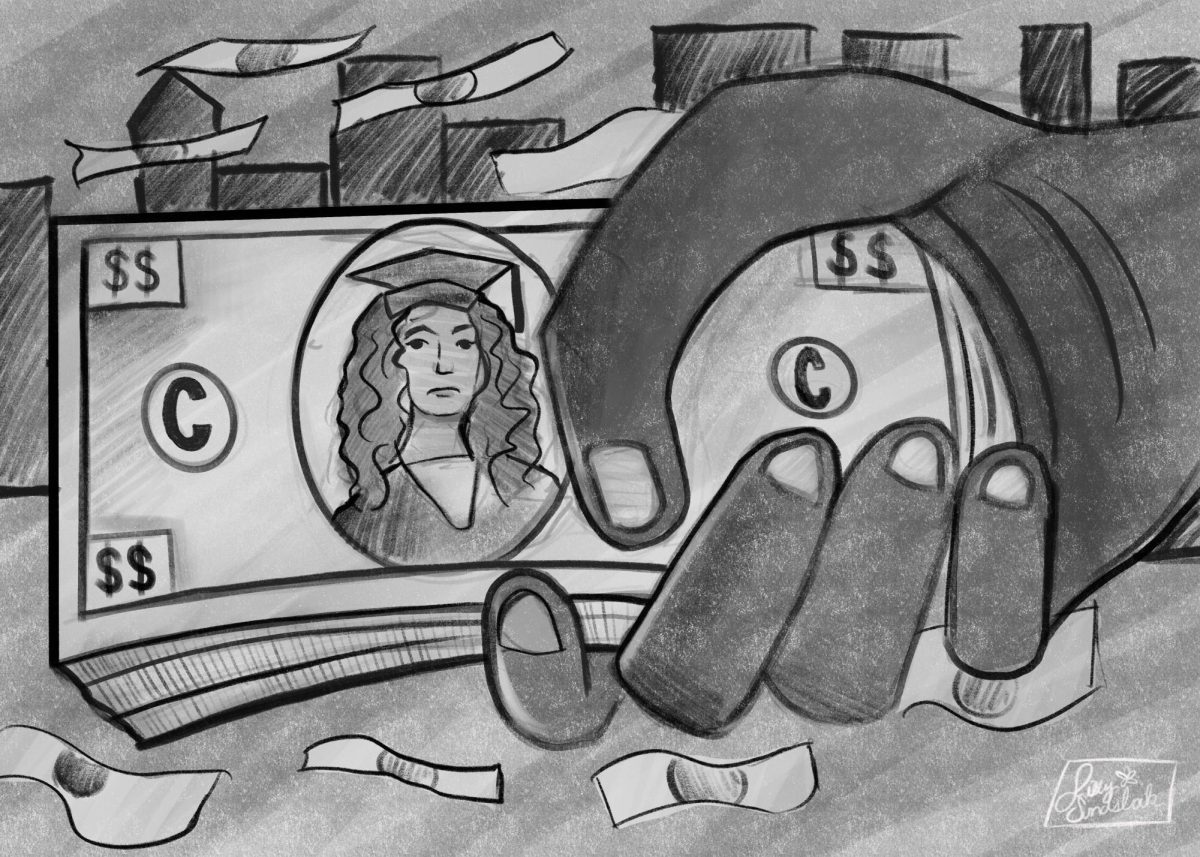

Bring Chicago Home would increase the real estate transfer tax (RETT) for properties sold for more than $1 million to create a designated revenue stream to address homelessness in the city. The referendum calls for the RETT to decrease for properties under 1 million dollars. The RETT is a one-time tax.

On Feb. 23, Cook County Circuit Court Judge Kathleen Burke ruled the Bring Chicago Home referendum was invalid after a lawsuit brought by The Building Owners and Managers Association. However, on March 6, the Illinois Appellate Court reversed Judge Burke’s ruling.

If a simple majority of voters check “yes” on the “Fair Share for Affordable Housing” referendum in the Chicago primary elections on March 19, that will enable the Chicago City Council to pass an ordinance changing the RETT. Tarullo said the RETT will increase for 7% of home buyers and decrease by 93% while generating an additional $100 million a year for permanent housing and supportive services.

Tarullo said the funding would go toward:

- Permanent housing and supportive services for those living in it

- Programs to prevent homelessness and support to assist people in finding and maintaining stable housing

- Non-congregate shelters and limited funds for congregate shelters

A community-led advisory board would recommend how the money should be allocated and prioritized.

Tarullo said most home buyers and sellers wouldn’t notice the additional tax. “We’re not going to negatively impact the everyday Chicagoan,” she said. “We care about our neighbors, and we have the power to house way more people than we are right now.”

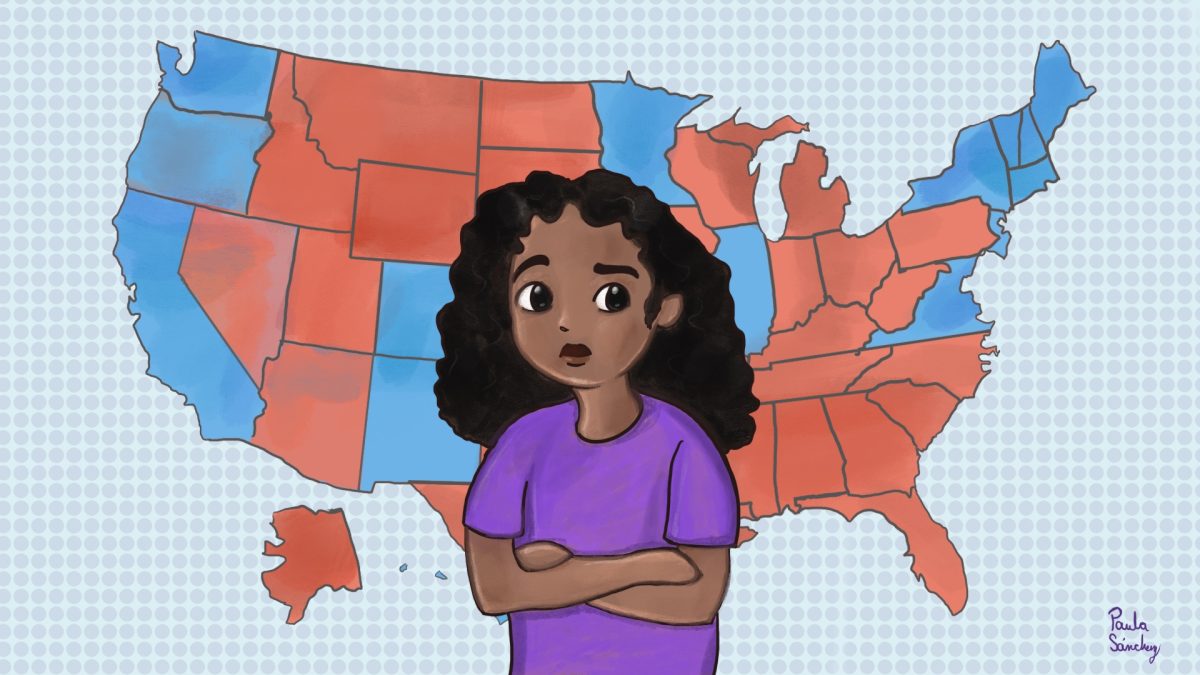

Columbia students are both enthusiastic and concerned about the potential consequences of the referendum.

“As a renter myself and a first-time renter… I just wish there was a lot more information for renters about what that [the results of the referendum] could look like,” said Sarah Bonds, a senior musical theater major who rents in Edgewater. “If they could make a separate clause or law that would prohibit larger royalty companies, who could probably afford to take the hit honestly, about letting that trickle down to renters because we can’t afford it.”

Ana Salazar, a junior communications major residing in Cicero, said people don’t tend to take homeless people seriously.

“They are deserving of a warm place to stay during the cold winters and cool places for the summer, so funding taxes to housing and shelters for the homeless is the type of humanitarianism we need to see more of,” Salazar said.

There are models from other cities where an increased RETT produced an effective revenue stream to help those who are homeless. Tarullo cited Santa Fe, N.M.; Long Island, N.Y. and Los Angeles, Calif. as successful inspirations for Chicago’s referendum. “This is a popular mechanism for creating affordable housing in cities because our federal government is not doing nearly enough to address the problem,” Tarullo said. “Cities need to step up and this is one way we can.”

Other local solutions have fallen short of addressing the homelessness crisis and acted more as “Band-Aid solutions,” Tarullo said. The Chicago Coalition for the Homeless believes Bring Chicago Home can make a permanent difference.

“We’re going to tax the rich to pay for housing for people who don’t have a place to live,” she said. “That is a beautiful thing.”

Copy edited by Myranda Diaz

Samantha Ho is a junior journalism major from north suburban Chicago residing in Bucktown. This story was reported from her Reporting I class.