Homeownership a remote dream for millennials

Homeownership a remote dream for millennials

February 12, 2018

The nation’s $1.4 trillion student loan debt significantly affects millennials financially, and a recent study highlights how home ownership has become an even more distant dream for the nation’s largest generation.

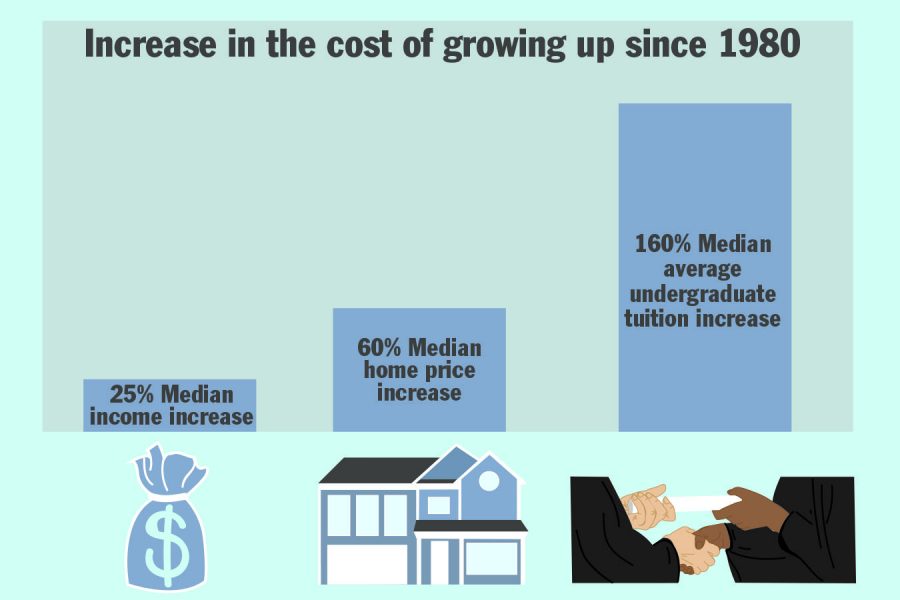

The average cost of an undergraduate degree and the price of owning a home have greatly exceeded the median income since 1980. While income has only risen 25 percent, the median home price has increased 60 percent and undergraduate tuition has skyrocketed 160 percent, according to a Jan. 19 study by Apartment List, an online apartment finder.

While the findings in this study were no surprise, Chris Salviati, a housing economist and author of the study, said the savings disparity between college graduates with and without student debt was striking. The statistics speak for themselves, Salviati said, and the reality forces millennials to save more money for a down payment while still paying more for apartments in the interim.

“The magnitude of that difference between the three groups [was surprising],” Salviati said. “But also college graduates without debt are still not in great shape to achieving homeownership.”

For millennials in Chicago, the burden of student loan debt cuts the savings for a down payment on a house by two-thirds. College graduates without student loan debt have an average of $18,680 saved, while college graduates with debt have only $6,310. Meanwhile, millennials who lack a college degree are still at a financial disadvantage with only an average of $2,330 saved for a down payment, according to the study.

For most American families, Salviati said a house is their greatest asset and the primary wealth creator. Should these trends continue and fewer millennials become homeowners, it could contribute to even greater wealth inequality and questionable retirement security in the future, Salviati noted.

Judith Scott-Clayton, an economics and education associate professor at Teachers College, Columbia University in New York City, echoed Salviati’s worries about student debt. She added that the college students who default because of loan debt are those unable to graduate.

“Students across the board—low income, middle income, high income—are taking on way more debt then they did in the past, [and] that’s an uncomfortable transition,” Scott-Clayton said. “But in terms of the consequences for life outcomes, the tragedies are concentrated not among college graduates with tens of thousands of dollars in debt, [but] among college dropouts.”

Scott-Clayton said there are misconceptions surrounding the cost of college in older generations’ eyes, noting that current students cannot simply pay off their tuition with part-time jobs as they did in previous decades.

College dropouts also might not be as integrated with the financial support services at an educational institution and may not be as well prepared for either the out-of-school transition or the debt burden they are carrying, Scott-Clayton said.

“People enter into this world where one mistake is made [and] it gets that much harder to get out of it,” Scott-Clayton said.

Although there are generational divides in understanding financial burdens, there could also be generational gaps for home ownership desires, said Alex Murfey, a 22-year-old 2016 cinema art and science alumnus who currently works as a Starbucks barista in Kansas City, Missouri. Despite the financial benefits of home ownership, he said it is not a top priority for him.

“I’m indifferent to home ownership,” Murfey said. “Somewhere down the line in the future if I’m a homeowner, that sounds great, but it’s not something I aspire to. It’s not something that I worry [or] care about.”

However, a majority of millennials, 68 percent, say their current residence is a “stepping stone” toward their home ownership goals. Meanwhile, 40 percent of those ages 25–34 have already planned a down payment for a house mortgage, according to a Bank of America survey conducted between January and February of 2017.

Murfey, who took out $22,000 in federal student loans, said most millennials—Columbia students in particular—seem to value personal experiences more than owning property. Murfey added that while his parents viewed home ownership as a necessity, millennials in artistic careers perceive it as an unrealistic financial goal.

“It’s kind of uncertain times now politically and you can’t tell how that’s going to affect markets,” Murfey said. “[When] the U.S. dollar plummeted because [Secretary of Treasury Steve Mnuchin] made an off-the-cuff comment about the dollar, when something like that can make such a big difference just in the value of a [single] dollar, to me, the country doesn’t seem stable enough for me to even think about trying to get in on [the housing] market.”