Proposed minimum wage hike triggers dispute between lawmakers, businesses

Proposed minimum wage hike triggers dispute between lawmakers, businesses

April 24, 2017

The fight for a $15-an-hour minimum wage has made significant progress both nationwide and in Chicago but is now advancing statewide.

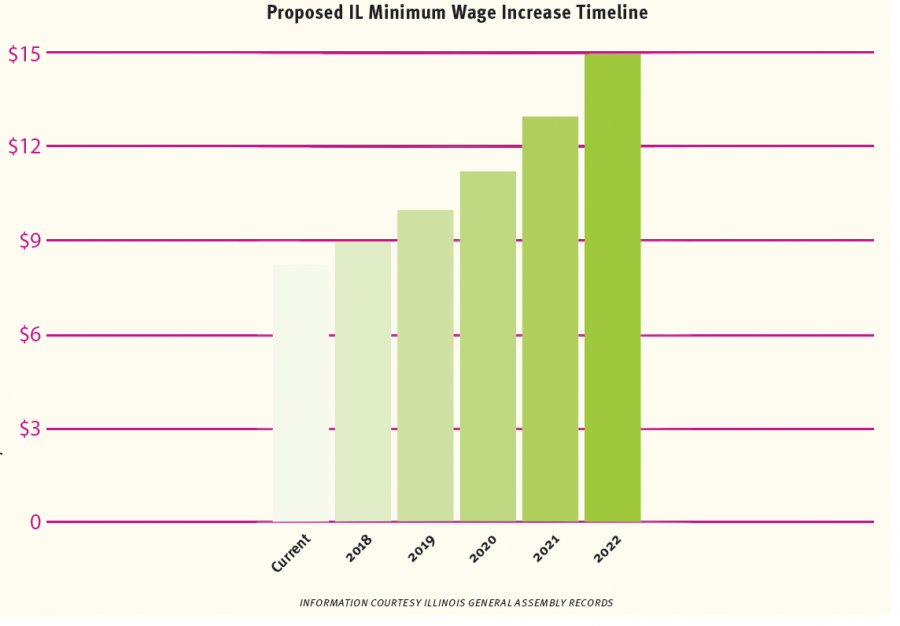

A recently attached amendment to House Bill 198 by state Rep. Will Guzzardi, D-Chicago, would incrementally raise the state’s minimum wage until it reaches $15 an hour in 2022, according to the legislation.

“Almost two and a half million people in this state earn less than $15 an hour, including a lot of folks in my district,” said Guzzardi, who represents the 39th District. “You have seen a national movement around the [Fight for 15]. You shouldn’t be living in poverty if you work a full-time job.”

Illinois’ minimum wage is currently $8.25 an hour, and in 2015, Chicago City Council passed an ordinance to phase in a $13 an hour minimum wage for the city, which has a current minimum wage of $10.50 an hour and is scheduled to increase to $11 July 1, according to the ordinance.

If Illinois residents earn the minimum wage, they would make $17,160 a year before taxes. That is not enough to get by as an individual, let alone raise a family, Guzzardi said.

Should the bill pass through the Illinois legislature and receive Gov. Bruce Rauner’s signature, the state minimum wage would increase at the beginning of each year.

“When you have everyday workers making more money, they spend more money,” said state Rep. La Shawn Ford, D-Chicago, one of the bill’s sponsors. “It’s a combination of people having a better quality of life, pay more taxes and improve the state’s financial crisis.”

However, David Jackson, the owner of a Save-A-Lot grocery store in downstate Clinton, Illinois, said the increase will cause “tremendous” inflation and “massive” layoffs for all businesses.

“People at the new starting wage will gain nothing because everything they buy will cost 25 to 50 [percent more],” said Jackson, who is also on the Board of Directors of the Illinois Food Retailers Association.

It is a misconception that the wage increase will help parents raise families because the majority of minimum wage workers are high school or college students, Jackson said. It should be up to the employer to decide whether to reward a worker with a raise or promotion not dictated by the government, he added.

According to 2015 statistics analysis by the U.S. Bureau of Labor Statistics, about half of minimum wage workers are under 25 years old.

Ford said he understands employers’ concerns, but the increase in wages would create more revenue for businesses and improve worker morale.

“If we keep people working poor and keep them in poverty, it only costs the state more money,” Ford said. “We put people in a position where they are eligible for state assistance like subsidies.”

Jackson dismissed the idea that an increased minimum wage would steer people away from obtaining government assistance. Those who are lucky enough not to be affected by layoffs will not need the assistance, but others will because there will not be any new jobs, he said.

Jackson said retailers on the Illinois border will be hit the hardest because customers will only need to travel a short distance to take advantage of potentially cheaper prices.

However, Guzzardi said data does not support the criticism that a state minimum wage increase will cause job losses and businesses to leave.

“There are [other] states and communities that have raised their minimum wage and we can see what happens,” Guzzardi said, adding that he used those states as models for the bill. “In jurisdictions who have raised their minimum wage [there] has not been any mass exit of jobs or any mass increase of unemployment.”

Among the states bordering Illinois, Wisconsin, Indiana, Iowa and Kentucky all have the federal minimum wage of $7.25 an hour and Missouri is $7.70 an hour, according to the National Conference of State Legislatures.

California, New York and Washington, D.C. have recently passed legislation to increase their minimum wage to $15 an hour, according to the National Conference of State Legislatures.

Guzzardi said the House bill provides tax subsidies to help small businesses adapt to the increased wages.

Companies with 50 or fewer workers would receive an income tax credit proportional to the wage increase; however, it would shrink each year and be eliminated once the $15 an hour pay is established in 2022, according to Guzzardi.

Rob Karr, president and CEO of the Illinois Retail Merchants Association, said the proposal is a “killer” for job opportunities even with the tax subsidies for small businesses.

The bill passed the House Labor and Commerce Committee, of which Guzzardi and Ford are members, by 17-6 on April 5, and both said they are confident it will receive the 60 required votes to pass the House.

Guzzardi said Rauner opposes the minimum wage increase, but he is “hopeful” the governor will sign the bill because the upcoming 2018 governor election could create an “outpouring of public pressure” for him to approve it.

The governor is open to increasing the minimum wage as long as it comes with reforms like workers compensation, said Rauner spokeswoman Eleni Demertzis in an April 20 email.

“It will be a test case for where the governor’s values lie,” Guzzardi said. “Is he going to stick up for the two and a half million people in the state who need a raise, or is he going to stick up for the profits of big corporations?”