Tax forms: College sees declining revenue; president and CEO receives 40% total compensation bump

2017 marked another year of enrollment decline for Columbia, and it was no surprise that total revenue also plummeted at a private school dependent on tuition dollars. The results were financially dramatic with the college forced to make cuts to resources and staffing while continuing its recruitment strategy in the hopes of stemming the tide.

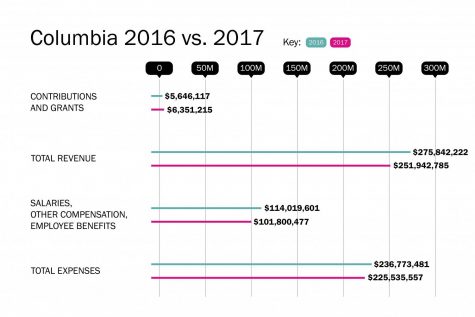

Total revenue dropped by approximately 9%, from $275,842,222 in 2016 to $251,942,785 in the 2017 reporting year, according to the latest IRS 990 tax forms report, an annual document submitted by nonprofit institutions. The report is released approximately 18 months after tax forms are filed. The most recent report shows information between Sept. 1, 2017, and Aug. 31, 2018, including contributions and grants, total revenue, assets and administrative compensation.

Between the 2016 and 2017 reports, enrollment dropped nearly 10%, from Fall 2016 to Fall 2017.

While there are few surprises for school officials in the federal report when it is released, it serves as a window into school finances for others including students, parents, faculty and unions that represent staff and part-time faculty.

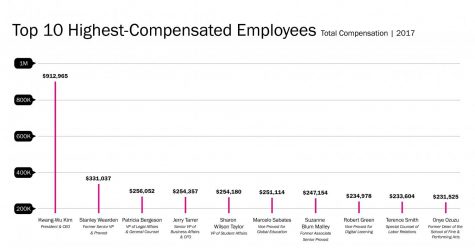

For many, especially in times of reduced resources and fewer hours available for adjuncts, eyes turn to the salaries of the highest-paid administrators listed in the report.

The total compensation for President and CEO Kwang-Wu Kim, for example, was $912,965, up by 40% from $651,091 the year prior. The report showed Kim’s base compensation went from $416,780 to $569,272. Kim’s total compensation includes his home, car, health care and other benefits, according to Lambrini Lukidis, associate vice president of Strategic Communications and External Relations.

Kim’s contract was extended through the 2023–2024 academic year by the Board of Trustees, as reported Nov. 18, 2018 by the Chronicle.

Kim’s salary is decided by the Board of Trustees. Lukidis said the college would not comment on Kim’s compensatory breakdown.

Kim decides top administrators’ salaries, in consideration with comparative analyses based on market location, the institution and the position, said Jerry Tarrer, senior vice president for Business Affairs and CFO.

But overall, salaries, other compensation and employee benefits spending went down more than 10% in 2017, from $114,019,601 to $101,800,477—or by approximately $12 million. During the reported 2017–2018 year, the college reported 3,624 individuals employed, down from 4,075 the year prior, or by approximately 11%.

As revenue declined, Tarrer said the college tried to be proactive by not hiring as many adjuncts, a move he said was reasonable given the fewer students enrolled.

For comparison, 2017 tax data reported by the Chronicle for Higher Education ranks Kim among the top 100 highest-paid college presidents in the U.S., with the highest-paid being Bryant University’s Ronald K. Machtley, who earned approximately $6 million.

Kim was listed in the 990 forms as the only Columbia employee to receive a bonus, totaling $42,500.

Faculty Senate President Sean Johnson Andrews said administrative salaries are being discussed across higher education institutions, but in this case reducing Kim’s bonus would not make much of a difference.

Of the $251,942,785 in total revenue reported for 2017, $211,930,709 was collected through tuition and fees and residence centers—both of which are central revenue generators for higher education institutions, said Michael Joseph, vice president of Enrollment Management.

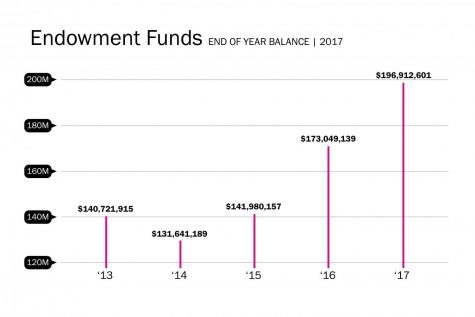

To absorb the enrollment hit, Joseph said colleges have to rely on other sources of revenue, including contributions and grants, as well as the endowment.

Unlike in previous years, 2017 marked an uptick in contributions and grants and the endowment, which is a pool of financial, real estate and additional investments. Contributions and grants increased by more than 12%, from $5,646,117 to $6,351,215.

Shawn Wax, vice president of Development and Alumni Relations, who joined the college in 2017, said in a Friday, Feb. 28 email to the Chronicle: “We continue to make progress with our fundraising productivity due largely to the support of foundations and the philanthropic community in Chicago. Our greatest challenge, although I see it as our greatest opportunity, is to increase alumni participation in our fundraising initiatives. Our alumni community cares deeply about the mission of Columbia; our job is to show them how they can support it.”

The college’s endowment funds increased by more than 13% in 2017, from $173,049,139 to $196,912,601. This was as a result of market gains as well as proceeds from the sale of real estate, Tarrer said.

To absorb the enrollment hit, the college turned to making cuts in areas such as real estate expenses, salaries and hiring freezes, said Johnson Andrews, also an associate professor in the Humanities, History and Social Sciences Department.

Johnson Andrews said the college’s overall financial health is largely due to a stronger business model that did not exist in the past.

“We’ve made it this far, so in that sense we’ve sustained that loss,” Johnson Andrews said.

At the same time, though, Tarrer said revenue is continuing to be allocated for maximum impact on students’ experience while reducing the cost on the administrative support side and shifting those resources over to the academic side.

“We’re encouraged by the enrollment growth we have seen thus far,” Tarrer said in Friday, Feb. 28 follow-up statement to the Chronicle. “Administrative leadership at the college, along with Columbia’s Board of Trustees, is working hard to ensure the long-term financial stability of the institution.”

As the college continues to evaluate its business model in the midst of more optimistic enrollment numbers, officials are investing in strategies to increase enrollment, such as expanding the number of scholarships available and keeping tuition as affordable as possible.

“We all hear the stories in the news about the rising cost of higher ed,” Tarrer said. “It’s really important, we believe, in our service to the student body, to find ways to make education more affordable.”

Joseph said institutions need to look to additional sources of revenue through recruitment strategies such as adding new programs, international marketing and online courses.

“[Cuts] are never easy. Hopefully that’s all behind us as we saw growth this past fall, we’ll see growth again this spring and we’re on track to see additional growth this coming fall,” Joseph said. “In order for us to do what we want to do and provide the kind of education that we want to provide, it is important for us to continue to see growth.”

Correction 03/05/2020 at 10:40 p.m.: In a previous version of this article, the bar graph representing contributions and grants stated correct numbers but the bars did not accurately represent the amount. The Chronicle regrets this error.