Students are struggling mentally from the financial strain of attending college, according to new data from the Student Financial Wellness Survey.

Greg Foster-Rice, associate professor and associate provost of student retention, said 71% of students surveyed in fall 2023 agreed that their financial situation has negatively impacted their mental health.

Within the last six months, 62% of students surveyed said they had to cut back on food due to their financial situation. Another 37% cut back on healthcare, 30% had to reduce their basic living expenses and 95% of students cut back on at least one category overall.

More than 1,000 students answered the survey, a response rate of about 17%.

First-year fashion major Marshall Kerr said he has been stressed about the cost of the college, which he can barely afford, and hopes to get scholarships to offset the increase.

“I know plenty of people who are already struggling basically paycheck to paycheck to pay for college and it sucks to know that they’re not gonna be able to come back here next year because of it,” he said.

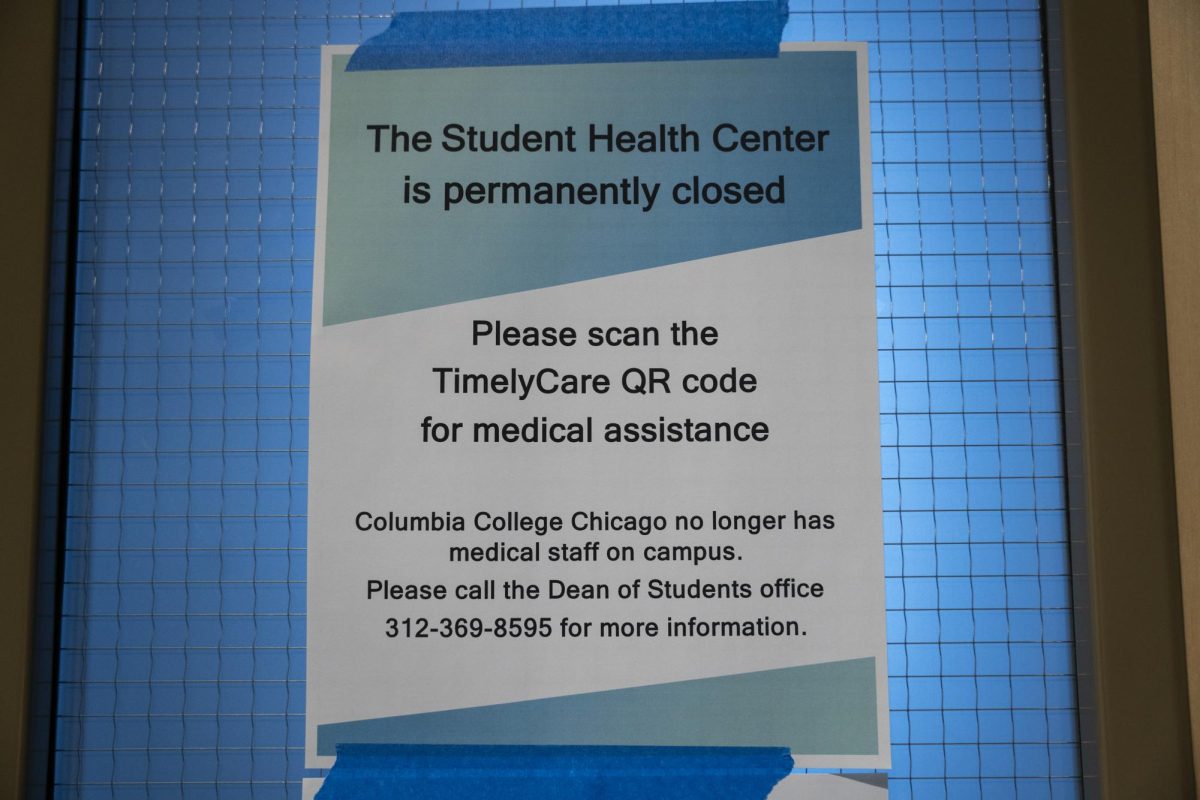

The college offers different kinds of mental health services to students, including individual therapy, community therapy, community referrals, crisis intervention and outreach. The Counseling Services office is located at 916 S. Wabash Ave.

Kerr has heard “pretty great things” about what Columbia offers for therapy and counseling but hasn’t personally been able to take advantage of the services because of his schedule.

“I would say that mental health in general is the kind of thing that is probably better addressed through systemic changes that actually make people’s lives better than by just doing more therapy, especially when we already have therapy in place,” he said.

For junior fashion design major Sarah Donnelly, the college could “do so much more on the terms of mental health.”

“I think that for a large college the way that tuition works, and the way the systems are in place where there’s a large majority of students who need mental health services that are just on a waitlist for the entire year, and by the time they end up being able to see somebody their issues resolved, they looked elsewhere, or they may have not received any help and their condition has worsened significantly,” Donnelly said.

Last month the Board of Trustees approved another tuition increase for next year, raising the cost by 5% — or an additional $1,538 — for the second year in a row to address the growing financial crisis. Fees also will increase by $31, and on-campus housing rates will rise by 3%.

An increasing number of Columbia students now receive discounted tuition, with 96% of first-year students receiving scholarships from the school, the Chronicle previously reported. Overall, most students pay half of the full amount.

While that has made the college more accessible, it has impacted the bottom line because Columbia relies on tuition dollars for its operating budget. President and CEO Kwang-Wu Kim has said that roughly one-third of the budget goes toward scholarship support, which is “not a sustainable number.”

Junior film and television major Chase Pickman said she had to get a second job on top of being a residential assistant at The Dwight so she could afford her education.

“I’m taking 18 credits, working two jobs and I’m a film student trying to work on sets because that’s what I came here for,” Pickman said. “And so it’s like, trying to get the most of my education, trying to afford my education, it all goes back to that stress. So, financially raising the tuition – yeah, it may be small scale, and only a couple percentiles, but that makes a huge difference.”

According to the survey, 73% of employed students who responded worked one job, and 27% worked two or more. Roughly 600 students work on campus and nearly 60 students are on the federal work study program.

Since the college’s population is “full of creatives” who are “more prone to mental health than a lot of other students,” Donnelly said the college could be doing more to assist these students.

“I do find that creatives are more likely to get into mental health issues and mental health crises on a much higher percentage,” Donnelly said. “And nobody should have to deal with that by themselves ever.”

The survey also found that on average, students spent $697 a month on housing, $262 on food, $81 on transportation and $146 on personal items. The average cost of books and educational supplies was reported to be $210 each semester.

“We are taking Student Wellness seriously and know that, like most colleges, it’s an opportunity for improvement,” said Foster-Rice, whose role targets ways the college can retain students.

Kerr said he doesn’t plan to leave but is worried about the future.

“I’m in a position similar to a lot of my other friends that basically the hope is to get careers in our fields before we even finish our college degrees because we can’t afford it already,” he said. “I can just say that the increased cost of tuition and also the increased cost of housing is only increasing that anxiety.”