Healthcare costs increase for full-time, non-union employees

April 17, 2017

Healthcare costs increase for full-time, non-union employees

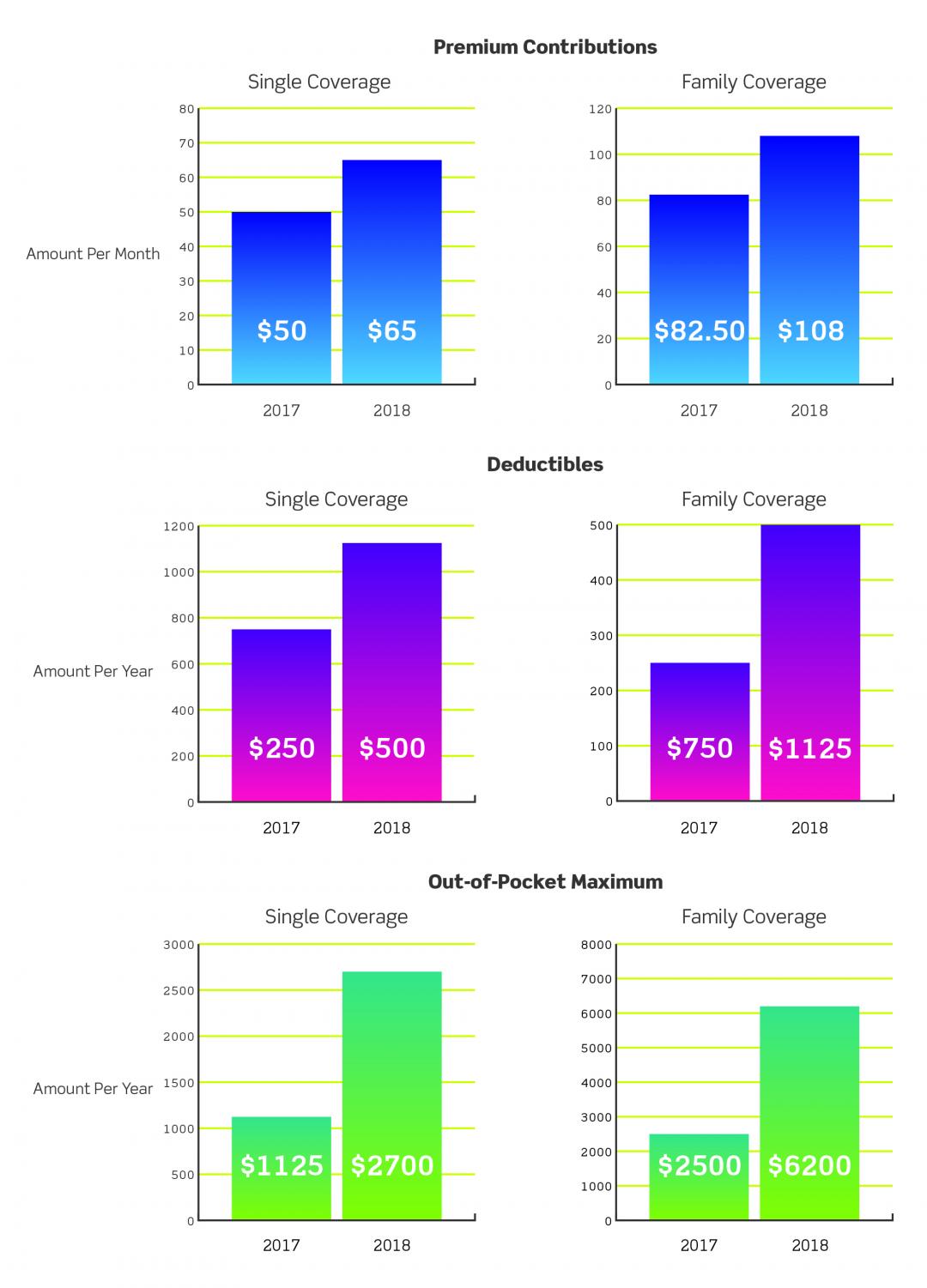

Changes to Columbia’s healthcare insurance plan design and cost-sharing structure—including higher premium contributions, deductibles, out-of-pocket maximums, copayments and coinsurance payments—were announced for full-time, non-union employees in an April 4 email from the Business Affairs Office.

Scheduled to go into effect Jan. 1, 2018, the changes, for both singles and those with families, were announced as the beginning of a series of incremental changes taking place over the next five years as the college attempts to lower its cost of healthcare coverage to reallocate funds to other goals, according to the email announcement.

Despite multiple requests from The Chronicle, college spokeswoman Cara Birch declined interviews with Senior Vice President and Provost Stan Wearden, Senior Vice President of Business Affairs and Chief Financial Officer Jerry Tarrer and Associate Vice President of Human Resources Norma De Jesus.

“Given ongoing challenges in higher education, Columbia is at a pivotal point in its history,” the announcement said. “We must reallocate our resources to best support institutional priorities and goals. This will allow reinvestment in human, capital, and technological resources for the benefit of our students, staff and faculty, which are all critical to fulfilling our mission.”

Rojhat Avsar, associate professor in the Humanities, History and Social Sciences Department and member of Faculty Senate’s Financial Affairs Committee, said while he is not affected by the cost increases, he can understand how they affect other faculty members if they spend more on their healthcare needs, particularly with out-of-pocket maximums and co-insurance payments.

Out-of-pocket maximums for single faculty will increase from $1,125 per year to $2,700 per year, and from $2,500 to $6,200 per year for faculty with families, according to the email. Co-insurance payments for all faculty will increase from 10 percent to 20 percent.

“Ten to 20 percent seems like a small increase, but let’s say [for] a treatment that costs $5,000, then you can feel the difference,” Avsar said.

The only benefit to not receive an increase was vision coverage for single employees, which remained at $5 per month, according the email.

These cost increases come after life insurance benefits cuts were made during the Fall 2016 Semester for full-time, non-union employees. Faculty were notified of benefits cuts reducing the payment to beneficiaries from 3.5 times to 1.5 times the employee’s annual salary in the event of their passing, as reported Sept. 26, 2016, by The Chronicle.

After the beneficiary payment was reduced, which came as a surprise to many faculty, the college’s Faculty Senate Executive Committee requested a meeting with college administrators to discuss faculty concerns and were assured that future changes would be discussed with them before being announced, as reported Sept. 26 by The Chronicle.

In an April 13 emailed statement to The Chronicle, Faculty Senate President and Associate Professor in the Photography Department Greg Foster-Rice said he was disappointed that further discussion of the changes did not take place with the senate’s Compensation Committee before the announcement. Foster-Rice said future changes were briefly discussed during the committee’s March 14 meeting, but they were not made aware of specific details of the changes or how soon the changes would be implemented.

During their April 14 session, the Faculty Senate approved two motions requesting a detailed rationale for the benefits changes to be presented to the Senate’s Compensation Committee, Financial Affairs Committee, and the full Senate before May 5, as well as directing the Compensation Committee to suggest improvements to the healthcare plan.

Elizabeth Davis-Berg, Faculty Senate member and Associate Chair of the Science and Mathematics Department, said during the April 14 session she calculated some of her family’s doctor appointment costs after the changes, but wished the announcement would have included examples on how the changes could affect faculty.

“Had the benefits package come with a scenario, that might actually be helpful because first glance is, ‘This is going to cost my family a lot more,” Davis-Berg said. “There may be things I’m missing; maybe it’s not as bad as it seems. At my first glance, I’ve got at least another $200-300 in just copays.”

According to the email, Columbia paid more than $12 million in 2016 for healthcare coverage for full-time faculty, staff and their family members. The cost to provide these benefits increases each year on average by 6.4 percent, the email also stated.

Dave Torri, area senior vice president of higher education practice at Arthur J. Gallagher & Co. insurance agency, said many higher education institutions have had to compensate for the rising healthcare costs.

In addition to shifting costs to employees, Torri said institutions are also trying to identify ways for faculty to help themselves through their insurance.

“A lot of what our clients are looking for now is more choice,” Torri said. “How do we provide those members with the ability to tailor their own plans? And looking not just at healthcare, but other benefits across the board and identify ways for faculty to truly pick and choose benefits they value more in their needs at the time.”

It is important for institutions to balance saving money with continuing to serve their employees needs, Torri said.

“Everything with regard to the benefit program is to attract and retain employees, so you always [have] to have that in mind and not just be concentrating on [shifting] costs,” Torri said. “You have to remain competitive with those programs [and] speak to the employees’ needs in a number of areas.”

Faculty members may see these increases in cost-sharing as a reduction in their compensation, Avsar said.

“Whenever you make more out-of-pocket payments, that would mean your pay is reduced, so some faculty members may think of this as an implicit pay cut of a sort,” Avsar said. “These are most applicable to cases where there are a lot of health care expenses. When there’s a birth, [or] accidents that requires hospitalization, those cases certainly faculty members would feel more pain economically.”