College’s net revenue continues to decrease

College’s net revenue continues to decrease

October 26, 2015

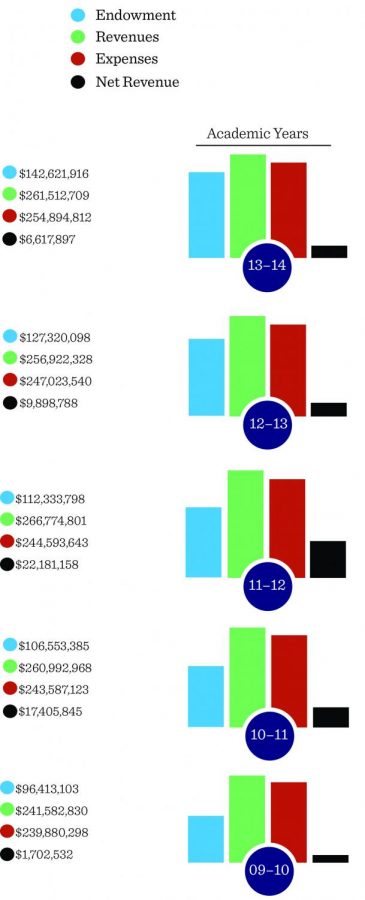

Columbia’s net revenue during the 2013–2014 academic year was the lowest it has been since the 2009–2010 academic year, according to the college’s most recent Form 990, an annual financial document nonprofit organizations must submit to the Internal Revenue Service.

In addition to the net revenue reduction, salaries and related expenses for college employees saw a decrease. However, at the same time, the college’s payroll rose by more than 150 paid employees as well as by significant raises for some top administrators.

The college’s overall revenue increased by approximately $4.5 million, but its total expenses increased as well, resulting in a drop in net revenue—the total revenue minus total expenses. The net revenue was only $6.6 million, down from the $9.9 million reported in the 2012–2013 Form 990.

Columbia’s overall revenue increase brought the college to more than $261.5 million in proceeds during 2013–2014—its highest revenue increase since 2011–2012. The college concurrently had a declining enrollment, and the Form 990 reports a nearly $5 million decrease in revenue from contributions and grants, but Matt Jaehrling, associate vice president of Business Affairs and Controller, said an increase in revenue came mostly from tuition and fee increases.

The Form 990 reported a $5 million decrease in revenue from government grants. Jaehrling said grants received from Gov. Pat Quinn through the Independent Colleges Capital Grant Program were not part of the fiscal year’s contributions to the college, causing the decline. He said the latest installment will appear in the 2014–2015 form.

“There were four or five total payments received, and they were staggered over [about five] years,” he said.

Revenue increased, as did the college’s total expenses, rising $7.8 million to about $254.9 million.

Jaehrling said net revenue is important to the college because it is invested back into the college through scholarships, building improvements or funds for future projects, thus the college needs to maintain a high net revenue by cutting expenses while keeping overall revenue up.

“Those are funds you can reinvest to make the college bigger and better,” he said. “The goal with a nonprofit is not necessarily to have huge funds every year, or else you’re probably not investing enough back into the college, but you want to have some form of profit on an annual basis.”

Jaehrling said the administration has made significant expense cuts, starting with salary expenses, because of “headcount reductions” among administration and faculty, which will be evident in 2014’s Form 990.

In the Spring 2015 Semester, the college launched a Voluntary Separation Incentive Program in which eligible staff and faculty could receive compensation for early termination of their employment. Many of these separations included payoffs in which they would receive one year of annual full-time salary, as reported April 6 by The Chronicle. The financial impact of the VSIP will be more evident on the Form 990 for 2015–2016, Jaehrling said.

“Over the past two years, we’ve had some pretty significant cuts we’ve done across [the college],” Jaehrling said. “Part of it is this goes back to [fiscal year 2013–2014] when there were some cuts made, but there were even deeper cuts being made in [fiscal year 2014–2015] to help balance with what the revenue structure was as well. I think [people will] see expenses go down even further in the next 990.”

While the total spent on salary expenses decreased, the number of total employees at the college—all student workers, staff, faculty and administration who filled out a Form W-2, a tax document distributed by employers—increased to 4,865, compared with 4,707 in 2012 and 4,598 in 2011.

The expense for salaries has traditionally increased or decreased in tandem with number of employees—with an approximate $2 million reduction in 2011 because of a reduction in employees and an increase of approximately $3 million because employees were added in 2012. But the college’s salary expense dipped to $131.3 million in 2013–2014 even with the addition of 158 employees.

Despite a more than $2 million decrease in salary expenses among college employees, nearly all administrators’ compensations continued to rise during the 2013–2014 academic year, according to the Form 990, which documents the total pay, from Jan. 1, 2013, to Dec. 31, 2013, of Columbia’s 10 highest-paid administrators.

Avery Buffa, an associate attorney who specializes in Form 990s at Mosher & Associates law firm, said it is common for compensation to reflect the calendar year in the Form 990 rather than the fiscal year, particularly for higher education institutions.

Current President and CEO Kwang-Wu Kim, who assumed his position in June 2013, had his partial salary listed as $169,700 and overall compensation at $254,205. These figures do not reflect full compensation due to Kim’s arrival at the college halfway through the calendar year.

According to reports from the Chronicle of Higher Education, leaders of private colleges earned an average of close to $400,000 annually in 2012, the most current data. Former President Warrick Carter, who left the college in June 2013, received a base compensation of more than $345,000 in his last year, more than $333,000 in 2012–2013 and about $337,000 in 2011–2012.

The Chronicle requested information regarding Kim’s full compensation, as well as compensation for other current administrative members who began their positions during the 2013–2014 fiscal year as opposed to the calendar year, including Senior Vice President and Provost Stan Wearden and Vice President of Business Affairs and CFO Michelle Gates. Cara Birch, a spokeswoman for the college, declined all requests for further information regarding Kim, Wearden and Gates’ compensation, which will be outlined in the following Form 990.

Vice President of Legal Affairs & General Counsel Patricia Bergeson, who is currently employed at the college and is new to the report, received $186,135 in total.

Carter received the largest salary of $346,791, a 4.1 percent increase from his 2012 base compensation. Carter’s other reportable compensation—which Buffa said can include compensation based on “longevity of service” and other incentive-based compensation, retirement compensation and nontaxable benefits like medical and health benefits—brought his total compensation up to $532,722 during the calendar year, down from the $677,098 he made in 2012–2013.

Administrators who received modest increases in total compensation include Vice President of Student Success Mark Kelly, whose total compensation rose from $257,228 in 2012–2013 to $257,948; former Vice President of Campus Environment Alicia Berg, who received $240,464, compared to $238,235 in 2012; Robin Bargar, then dean of the School of Media Arts, whose total compensation rose to $221,826, but saw a 1.9 percent increase in his base salary, going from $185,950 to $189,560.

Former Associate Vice President of Information Technology Bernadette McMahon saw a slight increase in total compensation from $213,495 in 2012 to $213,552 in 2013.

Eliza Nichols, then dean of the School of Fine & Performing Arts, received an 11 percent salary increase in 2013 with a total compensation of $273,831. By the Fall 2013 Semester, Nichols no longer occupied the dean position and was a faculty member in the Humanities, History & Social Sciences Department. Birch declined to verify when Nichols officially assumed her professor position. Former Associate Dean and current Chair of the Theatre Department John Green saw a 13.5 percent increase in his salary, earning $231,399 in 2013–2014.

Deborah Holdstein, then dean of the School of Liberal Arts & Sciences, received a 7.1 percent increase in total compensation with $224,527 collected in 2013–2014. Former Interim Provost Louise Love’s total compensation increased about 3.1 percent to $253,390.

Administrators whose salaries decreased include people who have since left the college, such as former Vice President of Legal Affairs and General Counsel Annice Kelly, who formally left in August 2013 and was on paid administrative leave before her departure, receiving $176,920, according to the Form 990. Birch also declined to verify the length of Annice Kelly’s administrative leave. Former Associate Vice President and Chief of Staff Paul Chiaravalle saw an 8.5 percent salary decrease to $225,062 due to a modestly lower base salary and nontaxable benefits; Eric Winston, former vice president of Institutional Advancement, experienced a 17.5 percent salary reduction, earning $211,176 during the 2013–2014 calendar year.

Annice Kelly’s 2013 compensation was not labeled as a severance payment, according to the document. Jaehrling said this was likely a “payout” as part of an employment contract, which he added does not have to be detailed in the form like severance is.

Buffa added that severance payments are typically created following someone’s departure from the college while a payout can be detailed in contracts.

“All of these people are executives, meaning they probably had an executive employment agreement that also details their compensation,” Buffa said. “Sometimes, severance agreements are included in those.”

Also new to the report are Warren Chapman, former senior vice president who received $254,969; Kenneth Gotsch, vice president and CFO until August 2013, who received $238,344; Kevin Doherty, who replaced Gotsch until November 2013 and received $176,431. Jaehrling said he does not think Gotsch and Doherty’s salaries overlapped.

According to Jaehrling, the overall decrease in salary expenses could be due to departures that occured in 2013.

“We had some reductions over the last couple years on the administrative side and some on the academic side as well,” he said. “Those [are continuing] to happen this year but aren’t reflected yet in these numbers. We had reductions in this year as well and they were at the academic level, so if you’re looking [at] the median salary or the average salary—people that came out of a mix from a reduction standpoint came out of that higher salary band, thereby decreasing overall salaries.”

Jaehrling said Gates’ and Wearden’s partial salaries, while undisclosed, are included in the overall salary expense for the fiscal year. Buffa added that it is difficult to say whether new administrative salaries would counteract those of administrators who left before 2014 in the college’s total salary expense without knowing their specific compensation.

“It could be that some highly-paid people left, it could be that the people coming in weren’t getting paid that much,” Buffa said. “There’s any number of things that have to do with the salaries that change from one year to the next and that’s fairly common and not out of the ordinary.”