Chicago consumers, communities could be affected by financial regulation rollback

Chicago consumers, communities could be affected by financial regulation rollback

February 13, 2017

If Financial regulations from the Obama administration are repealed, it could allow for “predatory” and “discriminatory” practices and lead to damaging affects in Chicago and the nation, according to concerned locals.

President Donald Trump’s Feb. 3 executive order calls for the Secretary of the Treasury to review the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, according to a White House press release from the same day.

“When people and families lose their home, it creates a lack of property taxes, which impacts Chicago Public Schools, surrounding homes and leads to an increase in crime,” said James Rudyk, executive director of the Northwest Side Housing Center, a local nonprofit organization that provides housing counseling and financial education.

Dodd-Frank, an extensive set of financial regulatory reform measures, was created in response to the 2008 economic crisis, establishing the Financial Stability Oversight Council and the Consumer Financial Protection Bureau. The council identifies risks within the nation’s financial system, and the bureau oversees consumer financial products, such as mortgages. CFPB has amassed $11.8 billion in consumer relief in enforcement work since its inception, according to the agency’s data.

While many voters are in favor of the law, the White House remains firm in its position that the act overregulates financial institutions.

“The Dodd-Frank Act has been a disastrous policy that’s hindering our markets, reducing the availability of credit and crippling our economy’s ability to grow,” said White House Press Secretary Sean Spicer at a Feb. 3 press briefing.

Rudyk said more financial protection support from state and city officials is needed. His organization is advocating for a bill called the Homeowner Bill of Rights, which will contain further protections for homeowners, such as extended periods of late notice before properties are foreclosed.

“We would like to see our legislatures and governor craft legislation and pass a bill that is able to help provide those protections [should they be exempt from federal law],” Rudyk said.

Alexis Goldstein, a senior policy analyst at Americans for Financial Reform—a Washington D.C.-based nonpartisan group of 200 civil rights, consumer, labor, business and investor groups that advocate for a strong, stable and ethical national financial system—said Trump voiced his disapproval of Dodd-Frank during the 2016 campaign. However, only Congress can actually repeal the act, which would be a “distressing” reality, she added.

Consumer Financial Protection Bureau is the “sheriff in town” for the American consumer when they are misled and the victim of theft by the financial industry, according to Goldstein.

“Often, when people are charged illegal or deceptive fees, they are [small amounts],” she said. “You probably can’t afford to hire a lawyer to sue your bank over those [amounts] but if it happens to a bunch of people over [time], that can add up to millions of dollars that are stolen.”

Goldstein said these agencies exist to make sure the country is not “caught blindsided” as it was in 2008, which caused trillions of dollars to be lost in the economy and more than 10 million people to lose their homes.

According to Goldstein, there is no official number of individuals who lost their homes during the 2008 recession because the government did not track that statistic, however, CFPB is currently reviewing the data.

Other avenues Dodd-Frank created to protect homeowners include the Qualified Mortgage rule—which restricts mortgage loan lenders from granting loans to people who do not have the ability to repay them and the Truth in Lending Act—which creates more transparent forms for mortgage loans, according to CFPB and the U.S. Department of the Treasury.

The financial protection reforms have also been important for student borrowers. CFPB is currently suing Navient Corp., the largest student loan agency in the nation, for illegally steering student borrowers to more costly repayment plans, according to the lawsuit.

Other state attorney generals have filed lawsuits against Navient, including Illinois Attorney General Lisa Madigan, as reported Jan. 30 by The Chronicle.

“These are the actions that CFPB take to stand up for students,” Goldstein said. “If the executive order results in the treasury secretary deciding to [recommend Congress act] in rolling back CFPB, that is going to harm students.”

Navient has denied any wrong doing and stated there are other motivations behind the lawsuit.

“Navient has a responsibility to its customers, shareholders and employees to defend itself—publicly and in court—against this unsubstantiated, unjustified and politically driven action,” the company said in a Jan. 18 statement. “We cannot and will not accept agenda-driven ultimatums designed to get headlines rather than help for student borrowers”

Juan Calixto, vice president of external relations at the Chicago Community Loan Fund—which has provided assistance to homeowners affected by the 2008 recession—said there is an important need for financial regulation, but there could be “overregulation.”

“I could understand when financial institutions say ‘we can’t read [thousands] of pages of regulation, and it costs us money to act on these,’” he said. “But the flip side is there has got to be a balance.”

The Senate has not yet confirmed Trump’s nominee for secretary of treasury, former Senior Executive at Goldman Sachs Steven Mnuchin. Critics claim he has conflicts of interests that could cause him to not objectively review Dodd-Frank.

Goldstein said Mnuchin’s time at OneWest Bank is concerning because the bank engaged in “predatory foreclosure practices.” He had also denied revealing the number of foreclosures the bank served as asked during his Senate hearings, she added.

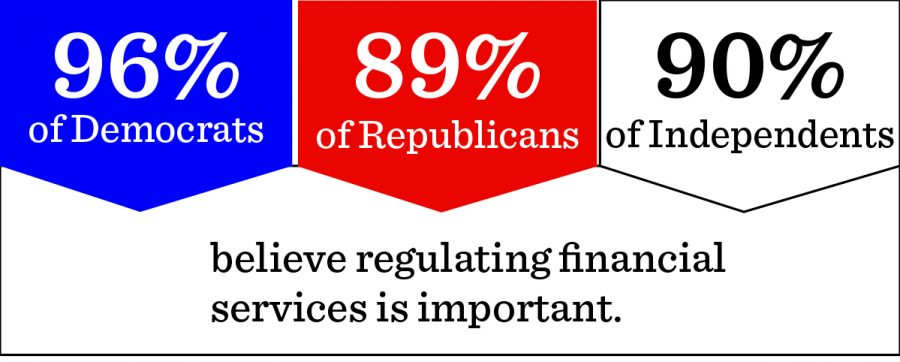

If the secretary of treasury were to recommend rolling back the financial protections of Dodd-Frank, it would become an ethical battle in Congress, according to Goldstein. Polls, such as one released July 15, 2016, by Lake Research Partners, show regulation of financial servers, such as Wall Street, financial firms is a nonpartisan issue among their constituents, she added.

“At the end of the day, [Dodd-Frank] and CFPB get scammed Americans their money back,” Goldstein said. “It is going to be difficult for Republicans if they decide to pick a fight over an agency who gets you your stolen money back.”