Administrators’ salaries rise, college’s financial cushion dwindles

October 10, 2016

In the midst of tuition increases, a shrinking endowment and a decreasing number of college employees, administrator compensation rose, including a multimillion-dollar payout to a former president, according to the college’s most recently completed Form 990.

The form, an annual Internal Revenue Service document completed by nonprofit organizations and institutions, contains information from the 2014–2015 fiscal year.

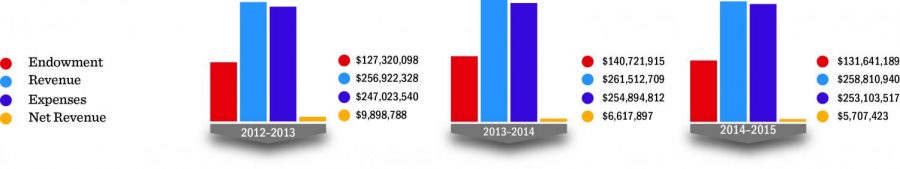

Though the college’s overall expenses decreased slightly—$253.1 million, down from the $254.8 million in the 2013–2014 fiscal year—the college’s net leftover also decreased to $258.8 million from $261.5 million. Because of this, the college’s net revenue, approximately $5.7 million, has continued moving downward. The net revenue was more than $22 million in fiscal year 2011–2012.

Despite the drop, Matt Jaehrling, associate vice president of Business Affairs and Controller, said the expense decrease is good “to an extent,” because it shows the college is able to cut expenses in order to have funds left over when revenue falls.

“We want to invest profit back into the college whether it’s buildings, student programs, a student center, for example, or to make sure there’s profitability each year,” he said. “In order to maintain that profitability, we have to maintain expenditures as revenues decline as well.”

In addition to President and CEO Kwang-Wu Kim’s full pay—officially disclosed for the first time since the beginning of his presidency in August 2013—of approximately $577,000, the most costly employee compensation was that for former President Warrick Carter. Carter, who left after more than a decade of service at the college, received more than $2 million in his reported payment.

These types of payouts, which usually take years to come up with , often come from a separate pool of money maintained for specific situations, according to Avery Buffa, an attorney at Mosher & Associates who specializes in Form 990s.

Jaehrling, however, said Carter was paid out of the college’s salaries allotment.

Jaehrling said he did not know the specifics of Carter’s agreement or contract, but usually a metric based on the number of years an employee served at the college would entitle them to a certain payout.

The compensation section of the Form 990 is based on the calendar year and not the college’s fiscal year, which runs from Sept. 1, 2014, to Aug. 31, 2015, he added.

Some of the other highest-paid administrators listed include former employees Mark Kelly, Warren Chapman, Bernadette McMahon, Alicia Berg and Robin Bargar, all of whom received more than $200,000.

Louise Love, a former provost who left the college in June 2014, received approximately $150,000.

Love said in an Oct. 6 interview with The Chronicle that she is unsure why her compensation was more than half of her previous salaries, saying it seemed “too high” unless benefits and insurance were included.

She added that because she never negotiated a contract for pay—which may be the reason she was not paid for the full year—this should be the last time she appears in the annual 990 document.

“[There’s] a variety of reasons why people might get more time [or] pay even though they’d left but I was just a very simple case,” Love said.

Richard Dowsek, current interim vice president of Business Affairs and CFO who also held the position in 2014, also received one of the highest payments—nearly $250,000—despite only working seven months of that fiscal year.

“Coming in as an interim person or consultant, you would expect to pay someone a higher rate because they’re not an employee of the college,” Jaehrling said, adding he doesn’t know the specifics of Dowsek’s negotiations.

Current employees on the list include Vice President of Legal Affairs and General Counsel Patricia Bergeson, who earned $245,253; Eliza Nichols, former dean of the School of Fine & Performing Arts and current professor in the Humanities, History and Social Sciences Department, who earned $228,796; Deborah Holdstein, former dean of School of Liberal Arts & Sciences and current English Department professor, who earned $253,369; John Green, former associate dean and Theatre Department Chair, who earned $226,581; Caroline Latta, former academic dean who left that position in 2001 and current Theatre Department professor, who appeared on the list with $204,696 and Chief of Staff Dayle Matchett was listed for the first time with $187,402.

Though no longer working for the college, former Vice President of Legal Affairs Annice Kelly, who left the college in August 2013, received college compensation.

Annice Kelly told The Chronicle she does not know why she still appears on the form following her August 2013 departure.

The News Office denied requests for specifics regarding former administrators’ payments and their calculations, including the reason for Annice Kelly’s most recently documented payment.

For Carter and Annice Kelly, Jaehrling said he does not think payments will continue during 2015–2016, and added that the payments could have been made in early 2014.

Despite expensive top administration salaries, there was a decrease in overall salary expenses and number of employees, going from about $131.3 million and 4,865 employees in the 2013–2014 tax form to more than $127.5 million and 4,677 employees for the most current form.

“They’re probably getting rid of more people on the bottom,” Buffa said. “When they get rid of people, it’s also not what their salary is but their benefits. Getting rid of a lot of employees who maybe [have] lower salaries [and] also getting rid of their benefits helps bring down overall costs.”

Jaehrling said the lower total expenditure, despite the higher amount of administrative compensation, could reflect employees who left the college, positions that were not filled or employees who took the Voluntary Separation Incentive Program, an agreement made available to some full-time faculty and staff in the Spring 2015 Semester offering them a buyout.

In comparison to Carter, Kim earned a higher base salary than his predecessor. While the former president’s 2013–2014 salary before benefits was approximately $347,000, Kim started 2014 at nearly $369,000.

Buffa said changes in base pay for college executives could be a result of multiple factors, including the college comparing salaries from other institutions or recruiting highly regarded executives from other institutions.

The form does not document full salaries for current and recently departed administrators Senior Vice President and Provost Stan Wearden and former Vice President of Business Affairs and CFO Michelle Gates. Both assumed their positions in July 2014, but Gates left during the Spring 2016 Semester. Wearden earned $171,934 for his partial salary and Gates earned $117,586.

Requests for Wearden and Gates’ full salaries, which will be disclosed in the 2015–2016 Form 990, were denied by the News Office.

In addition to new compensation figures, the document also showed that the college is operating with a smaller endowment and losses on its investments.

The endowment, which represents Columbia’s savings, ended fiscal year 2014–2015 down. The college left the 2013-2014 fiscal year with a nearly $141 million endowment,which dropped to approximately $132 million because of investment losses and college spending.

While the college has traditionally not drawn money from its endowment, a fund that has continually grown since 2008–2009, the 2014–2015 fiscal year included board approval of more than $6 million, to be taken out to cover operational expenses, approximately double the amount it withdrew during 2013–2014. That year was the first time the college adopted this practice, according to Jaehrling.

Jaehrling said the withdrawal of endowment money to pay for operations is not directly related to the college’s declining revenue.

Bill Wolf, chairman to the Board of Trustees, said Columbia will continue to withdraw funds from the endowment. The amount withdrawn, he said, has and will continue to rise and be applied toward the essentials.

“The endowment is being utilized to help fund the operations of the school, which in turn funds the Strategic Plan,” Wolf said.

While millions of dollars were also taken out of the college’s endowment in 2013-2014, the investment revenue deposited into the fund was more than $17 million, following a several-year increase of money being put into college’s savings. For the 2014–2015 fiscal year, however, Columbia saw an investment loss of about $3 million, making it the first investment loss for the endowment since the 2008–2009 fiscal year.

According to data released by the Commonfund Institute, educational endowments’ investments returned an average of 15. 5 percent for the 2014 fiscal year. Columbia’s endowment decreased by 6.4 percent at around the same time.

As reported Nov. 30, 2015, by The Chronicle, the late former board chairman Dick Kiphart said he predicted the endowment would rise during this time.

“Dick is an eternal optimist,” Wolf said. “I’m sure what he was saying is we’re always hopeful that we’re going to see increase in market price and therefore an increase in the endowment. But we don’t have a crystal ball, so given what happened in the overall market last year, we did pretty well.”

Buffa said that while it’s not uncommon to see a dip in some years, he was surprised to see it in the most recently documented year because most clients he has worked with saw a trend upward during that time.

Buffa added that the college can be affected by continuing decline if the pattern continues in the following years.

“I don’t know what their approach is, but long-term, if you don’t have people contributing to the endowment, it can affect the school,” he said. “I would say that would be years. It would have to be like a ten-year trend.”

While the fiscal year shows a loss, Wolf said the calendar year showed more promise than the form does.

“Over the calendar year, the endowment was flat,” Wolf said. “The returns that were generated in the marketplace over the last five years have been pretty remarkable, and it’s becoming increasingly difficult in the market that we’re in with this low interest environment to continue to generate 8 to 10 to 15 percent of returns we had after the [2008–2009 fiscal year] fallback.”

The college also saw a sizable increase in the contributions and grants category of revenue, rising from nearly $8 million to more than $14.1 million. While the amount of gifts and donations stayed at approximately $3 million for the last two fiscal years, the final installment of a grant from former governor Pat Quinn brought Columbia’s grant total to about $10 million, up from about $4.2 million.

“One of the things we’ve decided to do with the administration and board is to step back and say, ‘How, over the next five to 10 years, do we build a new environment for alumni giving and for being able to have a base of giving?’” Wolf said.

Though the college’s ability to invest back into the college remains low, Jaehrling echoed statements from Wolf saying Columbia is in good financial health.

“Our balance sheet is very good as a college… Compared to a school of our size, we’re in a strong financial position,” Jaehrling said.