Tax forms released: Enrollment down, Kim’s bonus doubles

December 4, 2017

As tuition rises and enrollment drops, recently released tax forms also indicate a decrease in revenue, college spending, gifts and contributions, as well as an increase in college assets and administrative compensation.

The 990 tax forms, an annual Internal Revenue Service document completed by nonprofit organizations and institutions, are released to the public 18 months after they are filed. The forms released earlier this summer contain information from the 2015–2016 fiscal year.

Contributions and Grants:

The college’s total gifts and contributions, which include donations and grants, dropped by about 52 percent in the 2015–2016 fiscal year—$6,838,090—from the 2014–2015 fiscal year—$14,149,450. However, the FY14 gifts and contributions nearly doubled the $7,933,050 the college received in the FY13.

Senior Vice President of Business Affairs and CFO Jerry Tarrer said the drop could in part be attributed to the expiration of the Independent Colleges Capital Program grant, a state-funded award given to colleges to improve buildings and physical space. The last installment of the $15,071,368 grant was given to the college in FY14 and accounted for $6,258,509 of the gifts and contributions, according to the Comptroller Office.

“I would think of these [grants] as sort of anomalies,” Tarrer said. “This was a grant we were able to benefit [from] because the state offered it, but it is not something that is continuous, and it is sort of a blip on the radar.”

Tarrer said the drop can also be attributed to rotating vice president of Development and Alumni Relations positions during the time covered by the 990 form. The position sat empty between May 2016 and March 2017 after John Stern left the position, as reported March 27 by The Chronicle.

Tarrer added that judging from conversations with current VP of Alumni Relations and Development Shawn Wax, Tarrer anticipates the amount of gifts and contributions will rise in future years.

David Bea, principal and manager at Bea and Vanderberk Law Office, said it is common for nonprofits to see a high turnover of development positions.

“It’s like a sales job without the upside; you don’t get the commissions,” Bea said. “It’s a tough job, it really is, and finding a good person is very difficult for a nonprofit, so a lot of them do experience turnover.”

Total Revenue and Expenses:

Total college revenue fell slightly by more than 3 percent—a $7,944,855 difference— compared to FY14, $258,810,940, with FY15 at $250,866,085.

Tarrer said revenue has dropped because it is based on enrollment, which—as is the case at many other higher education institutions—has fallen in recent years.

“Anytime there is any fluctuation or volatility in enrollment—in this case a downward trend—we have to adjust expenses accordingly,” Tarrer said.

The college spent $12,495,450 less in FY15 than in FY14, but revenue-less expenses, or net income, totaled $10,258,018 in FY15, nearly double from the $5,707,423 revenue-less expenses in FY14.

The decrease in expenses can indicate department consolidations, retirement incentives or layoffs, Bea said.

Columbia saw a drop in its number of employees during the 2015 calendar year, reporting 4,096 employees compared with 4,667 reported the year prior.

“It looks like [the administration is] managing the problem,” Bea said. “All of the schools I’m aware of and the ones that are my clients are having similar kinds of problems where they are having to do layoffs and manage things as they go down.”

For FY15, Columbia closed with an additional $20,266,243 in assets as well as a $13,959,311 increase in liabilities, or debt, which means the college gained $6,306,932 in net assets throughout the year.

Tarrer said the college can gain net assets even though revenues are down because the college invests money in the bond or stock market, which can grow if those markets do well.

Administrative Compensation:

Salaries, compensations and benefit expenses also fell $14,912,443 between FY14 and FY15.

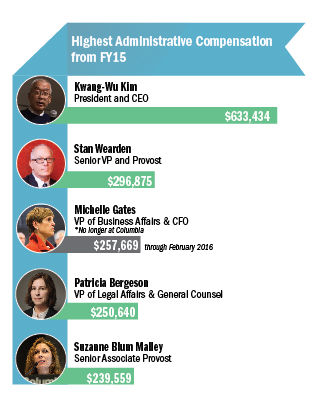

Some of the highest compensated employees at the college include President and CEO Kwang-Wu Kim, $404,280 base salary and $633,434 in total compensation; former Vice President of Business Affairs and CFO Michelle Gates—who left the college during the Spring 2016 Semester—$245,524 base salary and $257,669 in total compensation; Vice President of Legal Affairs and General Counsel Patricia Bergeson, $213,416 base salary and $250,640 in total compensation; and Senior Associate Provost Suzanne Blum Malley, $195,450 base salary and $239,559 in total compensation.

Tarrer said if there are concerns regarding administrative compensations, which are primarily based on market comparisons, people should look to what other administrators are paid at similar institutions.

The only adminstrative postion with compensation decided in a fixed contract is the president, Tarrer added.

“Any compensation [Kim] got outside of his salary is based on his contract, and that was established when he first got here,” Tarrer said. “There have been no adjustments to his contract per se.”

This year’s form includes the first year of Senior Vice President and Provost Stan Wearden’s salary and total compensation. Wearden’s base salary was reported at $272,750 with $296,875 in total compensation.

Included are the total compensations of former Associate Dean and current Theatre Department Professor John Green, $226,820; former Dean of the School of Liberal Arts and current Associate Chair of the English and Creative Writing Department Deborah Holdstein, $197,997; Dean of the School of Fine and Performing Arts Onye Ozuzu, $174,312; former Dean of the School of Fine and Performing Arts and current Professor in the Humanities, History and Social Sciences Department Eliza Nichols, $201,046; Special Counsel of Labor Relations Terence Smith, $228,246; and former Academic Dean of the College and current Theatre Department Professor Caroline Latta, $207,666.

Former employees whose total compensation are listed on the form include former Vice President of Student Affairs Mark Kelly—who left the college in July 2016 and was compensated through Aug. 6, 2016—$223,579; former Chief of Staff Dayle Matchett—who left the college in November 2016—$188,469.

Total compensation includes base salaries, bonuses, benefits and other reportable compensation and is recorded by fiscal year.

Kim was the only administrator to report a bonus, $40,000, which is double his bonus for the previous year. The college also spent less on administrative salaries, reporting $112,630,923 in expenses for FY15, compared to $127,543,366 reported for the previous year.

Endowment:

Although the college reported a drop in its endowment, which represents Columbia’s savings, during FY14, which had continuously grown since FY08, the endowment reported for the end of FY15 shows about a $10 million increase. The college left FY13 with a nearly $141 million endowment, which dropped to approximately $132 million for the end of FY14 because of investment losses and college spending, as reported Oct. 10, 2016, by The Chronicle. The end of FY15 left the college with a nearly $142 million total endowment.

Although the forms record the endowment funds by fiscal year, Chairman of the Board of Trustees Bill Wolf said the college follows endowment by the calendar year.

“The 990 is not a good constructive tool to use to look at how the endowment’s performed,” Wolf said. “When you think about the performance of investment securities and investment funds, it’s really measured at Dec. 31 typically. The 990 is really focused more on things like the revenue we take in from tuition and all against the expenses. That’s less instructive as it relates to endowment and the returns that are generated there.”

According to the most current form, 95.26 percent of the endowment funds were board-designated, which means the college’s Board of Trustees decided the funds would be put toward the endowment fund, according to Bea. Permanent endowments, for which the donor decides funds should be used specifically for endowment, were 3.51 percent of the total endowment. Only 1.23 percent of the college’s endowment was defined as temporarily restricted, meaning it is to be maintained for a specified amount of time.

FY14 included board approval of more than $6 million of endowment funds to be used toward operational expenses, approximately double the amount it withdrew during FY13, the first time the college adopted this practice. The use of these funds toward operational expenses was not directly related to the college’s declining revenue, as reported Oct. 10, 2016, by The Chronicle.

Wolf said the endowment can be used at the board’s discretion.

“Our endowment is kind of an unrestricted endowment,” Wolf said. “The board can use it for whatever it chooses to use it for. We don’t have to say, ‘There’s $2 million in funds every year that has to be used for this professorship or to fund that specific program.’ There’s not a lot of strings attached to the way the board can use that money.”

The college’s current endowment has grown over past years and is performing well, Wolf said. According to Wolf, the college’s endowment in 2008 during the country’s financial crisis was about $80 million–$90 million, but it has increased by 14 percent and currently stands at about $175 million.

“The school’s done a great job of managing its balance feed,” Wolf said. “[The college is] really doing a good job from my perspective in trying to do all we can to balance the goals of the school and doing things like building the new theater building, building out 1104 [S. Wabash Ave.], investing back in the school with the decline in revenue from the decline in enrollment … and I think we’re starting to have some real success.”

Even though the college is facing enrollment challenges and it will take time to recover, Tarrer said the college is working to improve the situation.

“Overall, the college is pretty solid, and even though we have these challenges, these are not unique to Columbia,” Tarrer said. “Across higher education, there are some real challenges. Relatively speaking, Columbia is on sound footing, although we have to be diligent, and we have to continue our efforts to strengthen the college.”