College’s endowment sees substantial increase

College’s endowment sees substantial increase

November 30, 2015

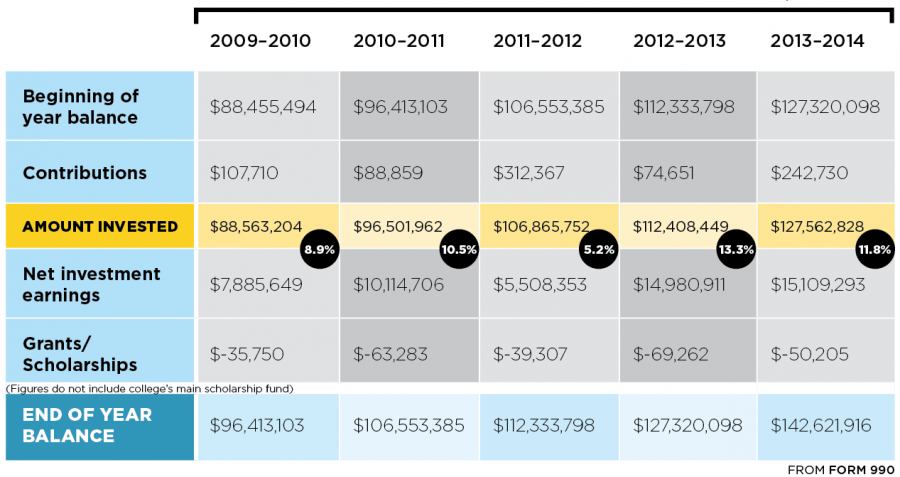

The college’s endowment balance increased about 12 percent during the fiscal year ending on Aug. 31, 2014, and increased about 48 percent throughout the five fiscal years prior, according to the college’s most recent Form 990, a financial document nonprofit organizations must submit annually to the Internal Revenue Service.

Dick Kiphart, chairman of the college’s board of trustees, said this continual increase is an optimistic sign for the college and will positively affect Columbia in future years.

“Obviously, any time you have more endowment, you have a chance to do more,” Kiphart said. “It is a good thing. Honestly, it is a great thing.”

Columbia’s net investment earnings—the money it makes by investing the endowment balance—for the fiscal year ending Aug. 31, 2014, were just more than $15 million, which is the college’s highest reported earnings in the last five fiscal years, according to the Form 990.

The college’s investment committee, which Kiphart said is headed by William Wolf, trustee and Founding Principal, BW Capital Partners, includes trustees and other volunteer investors. The committee reviews current investments and determines what investments to make next.

Kiphart said the committee works with Monticello Associates, an independent asset management consulting firm providing non-discretionary investment advisory services, which advises the college on good investment techniques in terms of investing in the stock market, bonds or other

alternative strategies.

Kiphart also said the college works with various investment firms and managers who handle the college’s funds, adding that the college invests in international stocks as well.

The college’s grants and scholarships for the fiscal year ending on Aug. 31, 2014, decreased 38 percent since the previous fiscal year, according to the Form 990.However, this is not the college’s main source of scholarship funds.

Contributions were more than three times higher than those of the previous fiscal year, according to the Form 990. This includes all donor gifts, grants and contributions received, as well as additional funds established by the college that function like an endowment but can be expended at any time at the college’s discretion.

The hiring of Jon Stern, vice president of Development and Alumni Relations, is one of the reasons contributions were so high, Kiphart said, adding that President and CEO Kwang-Wu Kim is also good at fundraising for the college.

“We really have enhanced our capabilities to go out and raise contributions,” Kiphart said.

Requests for interviews with both Kim and Stern were both refused for this story.

However, Stern was not employed by the college during the period reflected in the Form 990. Additionally, the fall 2016 budget, released Nov. 10 on the college’s website, revealed that gifts, contracts and other income has decreased by about 83 percent since the 2014–2015 fiscal year.

Kiphart said he thinks Kim has been successful at enhancing the college’s programs to deliver a more sufficient product to the students.

Kiphart added that he foresees continual growth to the college’s current endowment.

“More funds for the college [are] very good,” Kiphart said. “We intend to build [our endowment] even more.”

Interviews requested by The Chronicle with Michelle Gates, CFO and vice president of Business Affairs; Mark Kelly, vice president of Student Success; Jeff Meece, associate vice president of Enrollment Management; and Wolf were all refused.