SFS: Nationwide FAFSA change simplifies ‘tedious’ process

SFS: Nationwide FAFSA change simplifies ‘tedious’ process

October 3, 2016

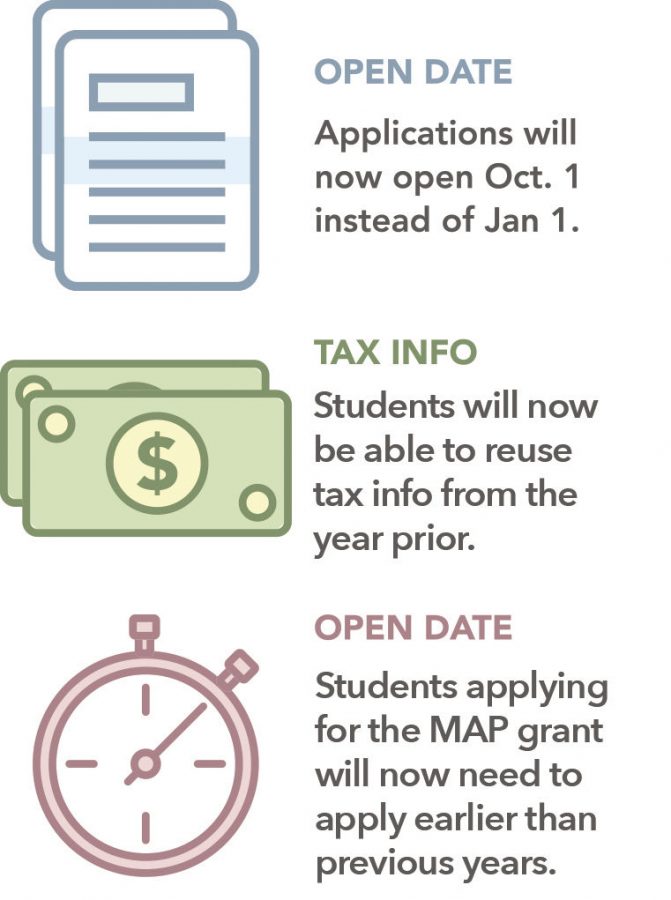

Students can now submit their 2017–18 Free Application for Federal Student Aid as soon as Oct. 1, according to a Sept. 27 email Student Financial Services sent to students.

The new timeline allows students to submit their FAFSA three months earlier than the original Jan. 1 submission date, and they can now use tax information from 2015, as stated in the email. According to a Sept. 26 press release from the National Association of Student Financial Aid Administrators, President Barack Obama pushed for this change in 2015.

“Last fall, President Obama took executive action to allow for the use of prior year income data on the FAFSA,” NASFAA said in the press release. “That change laid the foundation for the earlier release date of the FAFSA and has now opened the door for further simplification efforts within federal financial aid.”

According to Cynthia Grunden, assistant vice president of Student Financial Services, it is necessary for students to be aware of the changes.

“Columbia wants to get the message to students so they can take advantage of being able to [apply] earlier, and so our Illinois residents can get in line for Monetary Award Program grant which is first-come, first-served,” Grunden said.

The FAFSA website notes the changes were put in effect by Obama on Sept. 14, 2015, but SFS sent the email notifying students of the timeline change four days before the Oct. 1 enrollment opening date. Junior fashion studies major Ilaria Scarcella said the announcement did not leave a lot of time.

“It is kind of late notice,” Scarcella said. She also questioned if applying past the Oct. 1 date will affect the amount of scholarships and grants she would be eligible for.

According to Grunden, MAP grants are awarded while the funds last.

Grunden explained the college gives MAP grants to eligible students but whether that money is applied to a student’s account depends on the state budget. If the MAP grant does not come through by the time the semester begins, students must cover that portion of their tuition.

Because of another collegewide change, Columbia students will not receive their financial aid package until they submit their FAFSA and any outstanding documents. This means they will not know what their estimated awards will be until their application is complete.

“The reason we’re changing it is because we’re going to two years’ taxes prior, so it should be really easy for students to complete this process, and [ensures] the award letter they get initially is an accurate one,” Grunden said.

According to Christine Tvedt, assistant director of Outreach, Education and Financial Planning, SFS will be hosting workshops on Oct. 7, 12 and 21. Illinois Student Assistance Commission representatives will be present to offer one-on-one help and guide students through FAFSA.

Scarcella said she thinks using 2015 taxes will make the process of submitting FAFSA a lot easier and less stressful.

“You don’t have to wait for your tax information from your employers [since] you already have everything,” Scarcella said.

Another aspect of the timeline change is the IRS Data Retrieval Tool, which students will use to automatically import their 2015 tax information as well as their parents’ tax information, ensuring their FAFSA is accurate.

Grunden said these new changes should encourage students to be more proactive, adding that waiting to submit FAFSA would only be a detriment.

“It’s very easy for students to procrastinate because [FAFSA is] tedious,” Grunden said. “But it is something so important that [students] do it early. It makes the rest of their transition and registration much easier.”