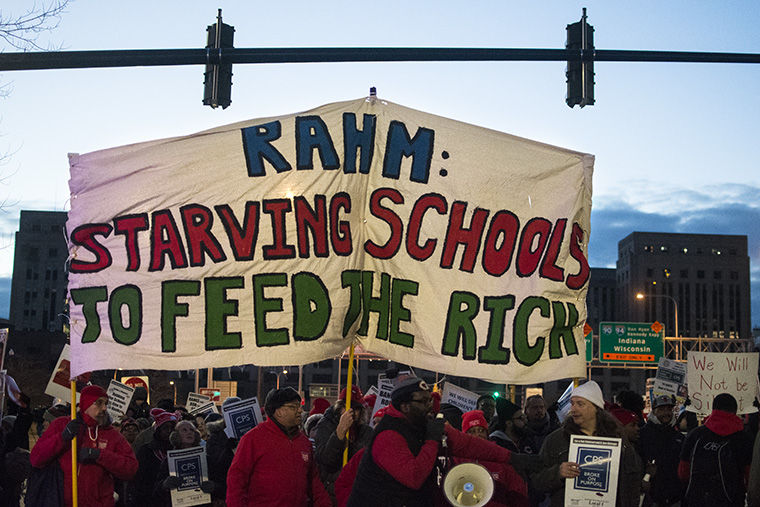

Aldermen, fair tax groups propose solutions to CPS budget crisis

Fair tax organizations demanded a tax on the wealthy and corporations to solve the city and state budget crises.

February 29, 2016

Alderman Pat Dowell (3rd Ward) will be giving Tax Increment Financing money—formerly committed to two projects in her ward—to the Chicago Public Schools, which is in the midst of a budget crisis, according to a Feb. 17 press release from her office.

“The CPS budget crisis is having a real and negative effect on schools, not only in my community but across the City of Chicago,” Dowell said in the press release.

Dowell’s TIF surplus will provide nearly $2.5 million to CPS, according to the press release.

The city’s website states that TIF funds, which are collected from property taxes, finance development projects in blighted areas.

“New revenue must come from the State of Illinois,” Dowell said in the press release. “It’s unfair for the state and our governor to hold our schools and our children’s futures hostage to score political points.”

According to CPS documents, the financially troubled school district is grappling with a $480 million gap in 2016, and expects a $1.1 billion operating deficit for fiscal year 2017, which the District says is largely driven by a state-mandated teacher’s pension contribution.

According to a July 2015 report from Catalyst Chicago, an independent magazine covering public schools, state law requires CPS to ensure teacher pension assets total at least 90 percent of what will be owed to retirees 35 years in the future; current fund liabilities now total almost $10 billion.

A City Council resolution introduced Jan. 13, signed by 28 aldermen, supports the use of TIF surplus funds to help CPS. According to the resolution text, the TIF program had $1.4 billion overall in funds as of 2015.

Tom Tresser, founder of the watchdog organization Civic Lab, has been combing through TIF data for years as part of the TIF Illumination Project. He said he has asked the city to perform a forensic audit of the program to determine what projects the $1.4 billion TIF surplus funds are committed to, as Mayor Rahm Emanuel stated in a July 29, 2015, press release.

Tresser organizes community meetings throughout Chicago, educating residents about how to access and analyze TIF data.

“People know something is afoot, especially in communities where mental health clinics have been closed,” Tresser said. “People are getting that there is a disconnect. This program is showering money on people who don’t need money.”

Tresser said he rejects the narrative that Chicago is strapped for cash and must resort to borrowing in order to fill gaps in already slashed budgets.

“The city is not broke,” Tresser said. “Its finances have been engineered. [Borrowing and cutting] are the alternatives that we’re left with and we must reject them.”

On Feb. 16, members of Grassroots Collaborative, a coalition dedicated to creating policy change throughout Illinois, released the People’s Agenda, a new report outlining a plan for solving the state and city’s respective budget crises and raising revenue.

The plan calls for closing “corporate loopholes and passing a graduated income tax, millionaire tax and financial transaction tax.”

Kristi Sanford, communications director for Fair Economy Illinois coalition, said in a Feb. 16 emailed statement the group wants the wealthy and corporations to pay a progressive tax rate.

Sanford said the wealthy are dodging a responsibility to invest in “education, human services and infrastructure” for the state.

“New revenue—not cutting funding—is the solution to the state’s budget problems,” Sanford said.