Airbnb subjected to Chicago Hotel Accommodations Tax

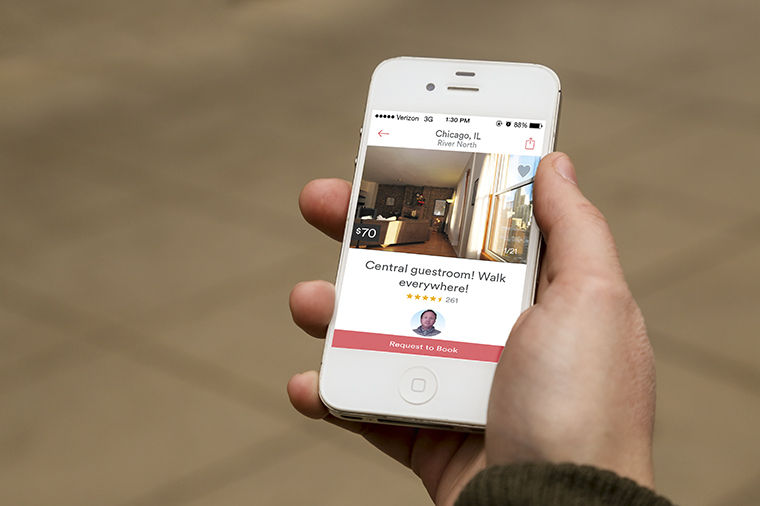

Photo Illustration by Lou Foglia

Airbnb listing

February 16, 2015

Airbnb–a website that allows people to rent out apartments for short or extended stays–will start charging customers the Chicago Hotel Accommodations Tax on Feb. 15 to meet revised regulations.

Airbnb connects leasers, or “hosts,” with people looking for a place to stay in the area. Some hosts, like cash-strapped college students, use the service to list their bedroom, while others will rent out their entire apartment to make some extra money. Chicago listings on Airbnb’s website range from $20 a night on someone’s couch to $1,000 a night in a refurbished Gold Coast studio.

Eric Mathiasen, 41, a software engineer for OptionsHouse, said he rented out a spare bedroom in his condo to help pay for graduate school and continues to rent the room. He has been hosting for four and a half years, and he has hosted more than 300 guests from 35 countries including Russia, China and Brazil. Mathiasen said he has had nothing but good experiences hosting through Airbnb and that his condo is the most-reviewed listing in Chicago.

Airbnb accommodations are most popular in areas where there is a high demand for hotel accommodations. However, most apartment leases specify that renters cannot have people living in their unit that are not under their lease, according to Michael Mini, executive vice president of the Chicagoland Apartment Association. He said many landlords have problems with their tenants violating their leases by using Airbnb.

“Most leases do not allow for tenants to rent out their units to other third parties without the consent of the property owner, so it’s in a direct violation of the lease,” Mini said.

Mini said property owners need to know who is occupying their buildings for safety reasons. Landlords are required to run background checks on tenants to maintain a safe environment, and they cannot do so if they do not know who is staying in their units.

In New York City and San Francisco, landlords have reportedly filed lawsuits against tenants who have been caught violating their leases by posting their units on Airbnb. Mini said to the best of his knowledge, Chicagoland apartment Association landlords have not filed lawsuits.

Mini said his association has not yet decided what they will do to address this third-party subleasing issue or whether they will approach the city to take legal action, and he added that it is up to landlords to deal with tenants on a case-by-case basis.

According to a city ordinance, tenants cannot rent any room out to anyone other than family members for less than 32 consecutive days.

Despite these issues, the city revised the Hotel Accommodations Tax at the beginning of January to make Airbnb listings subject to the tax.

Mathiasen said he thinks Airbnb is providing the city an incentive to let the service continue operating by collecting the tax.

“I think it is a step Airbnb views as necessary in order to keep from getting driven out of business through legal means,” Mathiasen said.

In a recent letter from the Airbnb Global Policy Chief David Hantman to the New York City Council and State Legislature, Hantman said Airbnb should abide by certain regulations to stay in business.

“We strongly believe home-sharing in New York should be subject to smart regulations,” Hantman said in the letter.

Hosts are now required to have hotel accommodations licenses, according to the Chicago Zoning Ordinance.

Dan Weise, 21, a junior hospitality leadership major at DePaul University, said he is excited to use Airbnb despite tax changes.

“The reason I want to use Airbnb is because I really like the spaces they offer. They are a little more comfortable than a traditional hotel room,” Weise said.

Under the Chicago Hotel Accommodations Tax, 4.5 percent of the host’s asking price, including any cleaning fees, will account for the tax.

Mathiasen said he was notified a month ago about the tax change.

“Almost every single [guest] has been a joy to meet and get to know, and that’s part of the reason I keep doing it,” Mathiasen said.